College Students and Money: 6 Things You Should Know

Hey, college students, it’s an exciting time! You’re off to school and onto the next chapter of your life. You’re establishing your independence, making decisions about your adult life, and you’re about to have a whole ton of fun (and studying. Don’t forget that part.) But before all that, let’s go over a few quick truths about the reality of college students and money:

- You’re officially an adult (and no longer dependent on your parents).

- Responsibility for your finances now shifts to you.

- You’re about to spend a lot of money.

This is the financial equivalent of never learning how to swim, and then being thrown into the deep end of the money management pool.

So let me pull out my safety whistle and toss out a few life preservers as you get started.

#1: You are poor.

Congratulations, you have entered the “Broke” phase of your life.

Your parents have probably been covering expenses for a while, and hey it was a blast grocery shopping with them and throwing whatever you wanted in the cart. But they are further along in their careers and make more money than you do. It will take you years to be able to afford the lifestyle your parents can afford.

It’s not as bad as it sounds. However, being realistic about your financial situation is an important lesson for young adults. The scarcity you’re feeling will help clarify what’s really important to you—it will also give you all of those, “When I was in college, I ate ketchup soup every night and liked it” stories that adults cherish. (You don’t have to eat ketchup soup.) But the amount of money you spend will need to slow down and become much more intentional.

#2: Develop good habits now and they will follow you for years. Develop bad habits now and you guessed it, they will follow you for years.

The financial decisions you make at this point in your life will follow you for years. If you borrow tens of thousands of dollars in student loans, you will need to pay that back at some point.

You will be deciding how to handle your day to day expenses. The method you put in place will likely be yours for years. And let me be clear—not making a conscious decision about how you’ll handle your money is still a decision. Every single person who manages their own money has a method for doing that.

Here are a few common money “management” approaches:

- There’s the “Living on Credit” Method. Expenses come up that you didn’t anticipate, so you’re “forced” to charge a bunch of stuff on the credit card. You intend to pay it in full, or at least tell yourself that you do. You get the bill and pay what you can. Credit card debt grows.

- Then of course the The “Why Bother” Method. You think you don’t make enough money to budget. You tell yourself that when you earn more, then you’ll start budgeting. You already know there’s not enough, so you can’t be bothered. But by checking out completely, you’ve eliminated the greatest personal finance weapon you have—awareness.

- There’s the terrifying “Cross My Fingers” Method. You never check your bank account because you’re afraid to look. You write checks for living expenses and hope that there’s enough money in the bank. Sometimes there’s not and you overdraft. Or, you use your credit card hoping you haven’t reached your credit limit. Stressful and scary, to say the least.

- Don’t forget the “No Method” Method. Bills come in. You ignore them as they pile up around you. You put out financial “fires” as they crop up. Eventually, you’re getting burned by unexpected expenses and smoked out by the stress.

You WILL be managing money. Be purposeful about it, be intentional. I personally favor the YNAB Method. Learn these Rules and let them guide you. And by the way, we offer a free year of YNAB for students. You should totally take advantage of that.

Get more bite-sized budgeting advice from The Dollar Scholar on TikTok.

#3: Student loan debt is not your only option.

The prevailing message is you HAVE to borrow for higher education. And with the rising cost of college today there may be some truth to that, but it’s not as black and white as it seems.

- Not all schools cost the same. You can minimize tuition by shopping around a bit and think about completing your general education requirements at a community college.

- YNAB’s second rule, Embrace Your True Expenses can help you save up money for school in advance, lowering the amount you need to borrow.

- You have earning power. Work as much as you can to help cover the cost of school. Get a part-time job, enroll in a work-study program, or adopt a side hustle for some spending money.

- Fill out the FAFSA prior to enrollment so you know exactly what your financial options and potential obligations are. Actively pursue all avenues of free financial aid, such as scholarships or grants.

#4: Money is about your priorities more than anything else.

You will spend money almost every day of your life. Money that you worked hard for. Make sure you spend it on the things that matter most to you and to spend it wisely.

Sit down with a pen and paper and answer the question: “What are my priorities?”. This will clarify your thinking and you can refer back to it as things change in your life. This is the key to financial wellness.

#5 Track your spending.

Along with the Rules, YNAB will help you track your spending, and in tracking lies the secret sauce to controlling your money—awareness. What we measure improves. So make sure you’re paying attention to your spending. Don’t let money escape without being really intentional about what it will do.

If you do accept student loans, keep track of your lenders, interest rates, and monthly payments by using your budget as a student loan planner. Repayment will be easier to manage if you organize your information during your first year of school.

#6 Budget to take control.

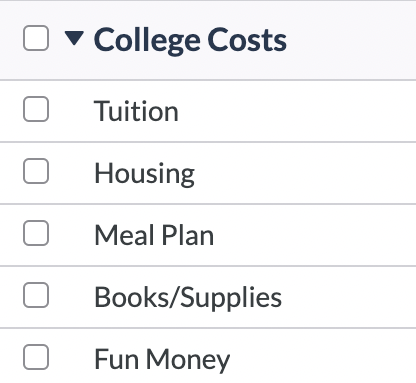

Budgeting gives you a way to be intentional with your money. Give each and every dollar a job. Ask yourself: “What do I want my money to do for me?” It can help you save money for non-monthly expenses, and allows you to adapt and adjust as life throws you curveballs.

It’s not about restriction—though it can help you see where to cut; it’s about making sure your spending is inline with your true goals in life.

And as your lifeguard, I have to add: don’t forget to wear sunscreen. That’s just good life advice, in general.

Ready for the very best advice when it comes to college students and money? You Need a Budget. Try ours for free.

.jpg)

.png)