9 Takeaways From People Who Don’t Stress About Finances

Last year sent a swift right kick, left hook, jab to the jawbone of many people’s bank accounts. But despite the tumult, despite the chaos, there was a small but steady group of people who were calm in the financial storm. So calm in fact that in a recent survey of over 6,000 respondents on financial stress and spending, 76% reported little to no financial stress last year. The survey includes both employed and unemployed respondents with 53% of households making less than $100,000 a year.

Some weathered job losses, income changes, and they experienced the somewhat universal dumpster fire of 2020 with unexpected monetary grace. So what are their secrets to financial zen?

We Asked the Big Question: How Did They Do It?

1. They All Use a Common Strategy

76% of respondents reported little to no financial stress in 2020. What did they all have in common? They all used a zero-based budget.

What exactly is a zero-based budget and why does it hold the power of 1,112 crystals? A zero-based budget is a way of organizing your money where every dollar that comes in is given a specific “job” or purpose. Picture the envelope budgeting system of our financially-savvy grandmothers where rent money was put into an envelope, grocery money was put into an envelope, and so on. This is zero-based budgeting, only these respondents were using the less time-intensive, more streamlined digital envelope system of the modern age: a budgeting app.

2. They Have a Budget (and Check It Frequently)

92% of respondents checked their budget once a week or more. Most respondents had regular check-ins with their budget. These short checks typically include activities like categorizing transactions, adding inflows, or moving money between categories.

3. They Avoid New Credit Card Debt

94% of respondents expected to skate through the holiday spending season without incurring any additional credit card debt. Compare that to the $1,325 average debt load Americans added over in the holidays in 2019 and that’s a stark difference indeed.

How did they do it? 66% of respondents budget monthly for holiday expenses, with 70% earmarketing up to $1,000 for the occasion.

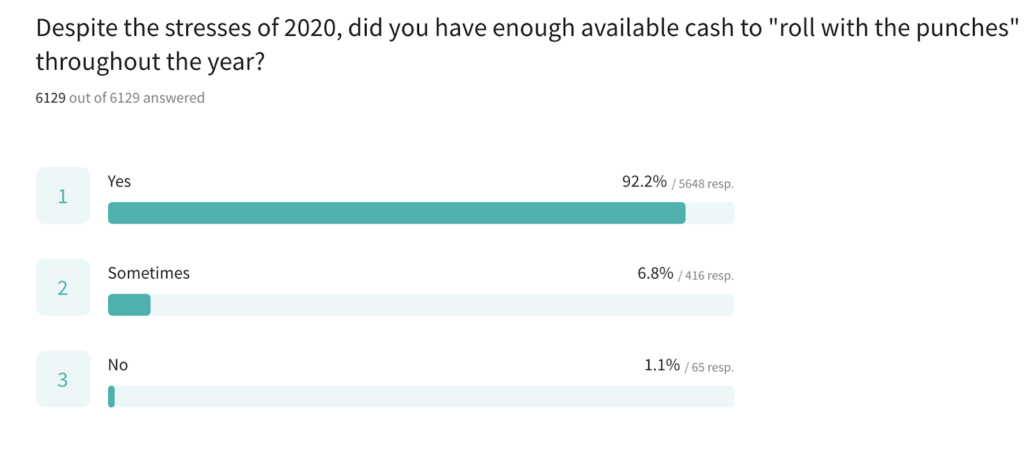

4. They Plan for a Rainy Day With Cash Reserves

92% of respondents said they had enough cash to roll with the punches of 2020. Keep in mind, no one knew COVID was coming. This took preparation months or perhaps years in advance.

And this isn’t just the high-income earners that were able to sock away cash reserves: over half of respondents make less than $100K per year, 15% made $50K or less/year, and nearly 30% of this cohort experienced a job loss (themselves or their partner) during 2020.

5. Their Budget is Flexible

2020 plunged everyone into a crazy funhouse mirror, minus the fun. Add with that, came priorities that changed: spending that was cut, spending that was added. Budgets bent but didn’t break.

66% reported spending more money on groceries in 2020.

Other popular places where spending increased

- Paying off debt (27%)

- Dining out (27%)

- Streaming services (23%)

- Medical (23%)

- Alcohol (20%)

While some spending categories increased, other categories greatly decreased in spending for 2020.

- Travel (75%)

- Gas (68%)

- Dining out (51%)

And interestingly,15% of respondents said they spent less on coffee in 2020.

6. They Said A Budget Gave Them Control, Peace, and a Reduction in their Financial Stress

When respondents were asked what surprised them the most about their budget in 2020, it was overwhelmingly positive vibes.

- 56% of respondents were surprised how in control they felt in 2020.

- 38% were surprised by how much they saved in 2020.

- 34% were surprised how much a budget reduced their financial stress.

7. They Used Stimulus Money Prudently

Those that received a stimulus check spent it on what many might consider boring yet responsible uses: paying off debt, building up savings, and getting a month ahead.

- 30.5% used it to build an emergency fund

- 25.2% paid off debt

- 16.4% used it to get a month ahead with their money

8. 98% Feel They’ve Gained Control of Their Finances

While many people struggle to get a handle on their finances, this group felt in control over their financial health.

- 67.5% reported feeling more in control of their finances than they did before using a zero-based budget

- 30.3% report feeling in total control of their money and financial future

9. They Have Big Financial Goals

The most popular financial goal for 2021 among respondents was to build wealth (26.4%).

Other popular goals were to pay off debt (22.5%) and save for a big purchase (21.1%)

“These insights show the impact a budget can have on limiting and, in some cases, reducing one’s financial stress,” said Jesse Mecham, CEO and Founder of You Need A Budget.

“In a year of economic upheaval, people’s plans have uprooted, and financial anxiety has been at an all time high. Having a hands-on spending plan and budgeting system in place provided an element of control. A budget puts people in the driver’s seat of their financial choices, allowing them to maintain peace of mind and change their priorities as needed.”

FOR MORE INFORMATION:

To learn more about YNAB, the user survey, or to schedule an interview, contact Haley Messner at haleym@ynab.com

METHODOLOGY:

This study was conducted for YNAB using TypeForm. The sample consisted of 6,090 responses with no fewer than 4,094 completed responses per question. Responses were collected from December 10 to December 14.

.png)

.jpg)

.png)