How to Save $30,000 in One Year: Our 3-Step Plan

Jacob and Connor thought home ownership would never happen. They made good money, but it never seemed to accumulate into a pile big enough for a down payment. Then with a simple three-step plan to save $30,000 in one year, that all changed.

The word “down payment” has always given me a tinge of fear when I hear it. It’s not that I don’t want to own a home—I do! It’s the seemingly-insurmountable amount of money I’d need to save before homeownership feels realistic. I would put off saving for it because, well, how will I ever get there?!

If this sounds familiar, I’ve got good news: you don’t have to be afraid, and you don’t have to put off saving any longer. A year ago, my partner and I had $0 saved for a downpayment. I’d basically written off the idea of owning a home altogether. I had consigned myself to a life of renting, forever at the whim of a property manager and their temperature controls. Today, we’ve saved $30,000 in one year for a down payment, and we’re steadily saving more each month.

We Saved $30,000 in One Year

Homeownership feels more within reach than ever. The best part? We didn’t do anything particularly special. We just did a little bit of work, a little bit of YNABing, and we saved more than we thought possible.

The Secret? Use YNAB to Save Money

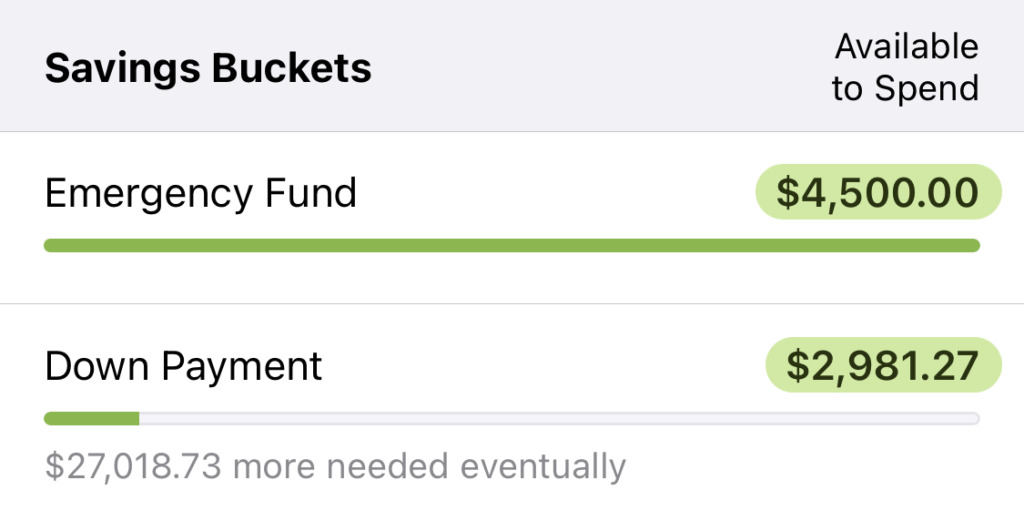

How did we save $30,000 in one year? Well, first and foremost: we worked the YNAB Method. We’ve been using YNAB for years, and it’s helped us not only gain total control of our money, but now it gives us incredible focus on where we want our money to go and how much we managed to save. In our case: toward a down payment.

Our Three-Step Plan to Save $30,000 in One Year

- Make saving for a down payment the highest priority and give it a separate category in YNAB.

- Funnel every extra dollar beyond regular income funneled into to this down payment category (Bonuses, tax returns, and extra money left over).

- We gave ourselves more “fun money”. (Yes, you read that right. More fun money. More on that later).

1. The Down Payment Was Our Top Priority

If six years of using YNAB has taught me anything, it’s this: define your priorities and your life will follow. In early 2019 we had a lot of priorities—new furniture, fun new gadgets, traveling, dining out—and our money was spread thin to accommodate all of them. We decided that saving for a house should be the priority we focused on in 2019. Two important changes followed:

We prioritized more money toward our house. In YNAB, we gave a bunch of our dollars new jobs.

The old jobs they had weren’t priorities for us anymore, so we took them out of their old categories and moved them to the house down payment category (picture the money moving from one virtual envelope to the other). That expensive gaming computer? Turns out I don’t want it that bad. New furniture? Maybe the house should come first.

Define your priorities and your life will follow.

By reallocating money we already had, we were able to set aside a few thousand dollars immediately. That felt awesome, and it was a huge boost to our momentum right off the bat.

We went through every category and adjusted our goals.

Our income is predictable and we know exactly how much is coming in each month (we both work and have good jobs). Our plan: allocate less money for things like clothing, home goods, and technology, then hike up the goal for our house downpayment category. We ended up with a really healthy savings goal—we aimed to set aside $2,000 every month for our house down payment.

This was all reflected in our category for a house down payment, but in addition you could choose to physically store this in a high-yield savings account to take advantage of the interest rates on that chunk of money. Granted, it’s not exactly a high interest rate, but with a .5% interest rate, you’d have just over an extra $100 by the end of the year.

2. We Saved Our Tax Refund

Have you ever received a big bonus or a fat check from the IRS? Those oft-unexpected windfalls can feel so exciting. Yet, more often than not, they’re gone before they hit your checking account. Having a pile of “extra” money can cloud your judgment, leading you to spend it on things that aren’t really a priority. Do you even remember what you bought last time? I sure don’t.

Because saving for a down payment was our number one priority, our money followed suit. When extra money arrived, we immediately sent it to the house down payment category. We tried to do this with everything—gifts, tax returns, bonuses, salary increases, etc. We changed our minds a few times (I really wanted that new Kindle), but that was okay. Saving 90% of our windfalls felt so much better than saving 0% of them. And turns out when you want to really start building wealth, this mindset goes a long way.

3. We Increased Our Fun Money

The third and most impactful change we made happened mid-year. We weren’t saving as much as we thought we would be—that $2,000 we were setting aside each month had a habit of disappearing when we overspent in other areas. Overspending happens—it’s unrealistic to expect it won’t. But if your dining out spending is eating into your down payment (like ours was) it’s time to do something about it.

My partner and I started brainstorming. We realized it was a mental game—we were being too restrictive! Our plan wasn’t realistic and we were feeling the effects.

To get back on track we decided to start allocating more to our Fun Money categories (like…a LOT more. We more than quadrupled the amount in each of our fun money allotments). I have one and my partner has one. We put the same amount of money in each, and it can be used for anything, no questions asked. The one caveat—all overspending would be covered with dollars from our “fun money” categories, taken equally from both.

This change had an immediate and dramatic effect. The next time I wanted something (like that Kindle) I was able to buy it without overspending another category—I’d just use my Fun Money. And if I didn’t have enough, I could easily save for a month or two.

The real win, though, arrived at the end of the first month, when we were deciding if we should go out to eat. Our dining out category was empty, and $40 of overspending didn’t feel that bad. Then I remembered that $40 in overspending meant I’d lose $20 from my Fun Money. I was faced with a choice: buy that thing I’ve been wanting or go out to eat because I don’t want to cook. That choice was ridiculously easy—we ate at home, a I wasn't even mad about it.

Since we made that change, we’ve saved $2,000 every month, without fail. There’s something about that approach that helped us see our priorities even more clearly. Overspending still happens, but much less frequently. And when it does, we have a plan to cover it that doesn’t hurt our progress toward our down payment.

Month after month we saved. There were still times when it felt like the cash we were setting aside would never be enough, but we persevered. Despite my fears, the quality of our life didn’t have to change that much. And we didn’t miss the things that did change—they weren’t priorities after all.

Let YNAB Be Your Guide

A year later we sat down for a monthly money meeting. I happened to glance at the house downpayment category and I was shocked to see $30,000! It’s not a category we touch, so months would go by without paying much attention to it.

That’s the true power of YNAB—when you decide what’s important to you and commit to it realistically, you might just wake up one day and notice you’ve saved $30,000 without even realizing it.

Spring is (almost) in the air and we’ve started popping around to open houses in some of the neighborhoods we like. I’ve got Zillow bookmarked on my computer, too. A year ago home ownership felt impossible. Today it feels like something that’s right around the corner. We’ll keep saving, month after month—every time we sit down to plan our spending, we’ll be just a little closer to our new home.

This post was originally written in March of 2020. Since that time, Jacob and Connor made their homeowner dreams come true and just moved into their first home!

Want to make your homeowner dreams a reality? Supercharge your savings today with the help of YNAB. You’ll be able to line up your spending with your priorities like never before. Try it free for 34 days, no credit card required!

.png)