How Many YNAB Categories Should I Have?

How many YNAB categories should I have? 12, 24, 158?

This is a question we’ve been getting since the dawn of time—err, well, since the dawn of YNAB in 2004.

It’s not just new budgeters that get bogged down with this question, either. As you move farther along the learning curve and develop a better understanding of your financial goals, you may realize that your initial YNAB budget category setup might not serve you as well as it once did—and that’s a good thing! Your budget should evolve as your financial situation (and life!) does.

There’s No Wrong Way to Categorize

Just like there’s no wrong way to eat a Reese’s, there’s no wrong way to categorize your budget. Sure, there are impassioned hordes on the internet that might have a definitive (and contradictory) stance on this question, but when it comes to your YNAB categories, you do you.

How Many YNAB Categories is Too Many?

You probably want me to say the answer is something definitive (like, 29) but it would make for a really short blog post. To be honest, the answer is different for everyone. Some people have 45, some people have 145. One woman (who met her now boyfriend through YNAB) had just eight categories when she was focused on paying down her debt.

So why isn’t there a correct number of categories? Well, a monthly budget isn’t just a record of your spending. It’s a personal finance tool designed to make your life better all around. Your categories are part of that process. When you have just the right amount, they’ll most effectively point you in the right direction—whether that’s eliminating overspending, paying down credit card debt, building up an emergency fund, or meeting your savings goals.

When in Doubt, Simple is Better

We suggest that budgeting beginners start with fewer categories and then let any new ones earn their way into your budget. You can always add or change them at any time, just remember: simple is better.

When you started using YNAB, whether it was today, last week, or last year, we gave you some categories and groups that we thought may be useful to get you started. The default category groups included:

- Bills – Create categories for your monthly expenses.

- Frequent – Includes expenses like groceries, transportation, and eating out.

- Non-Monthly – Categories to break True Expenses (like holiday gifts, annual subscription costs, or car insurance premiums) into manageable monthly chunks.

- Goals – Categories of expenses you’re saving up for, like travel, education, or home improvements.

- Quality of Life Goals – Categories for hobbies, health and wellness, and entertainment.

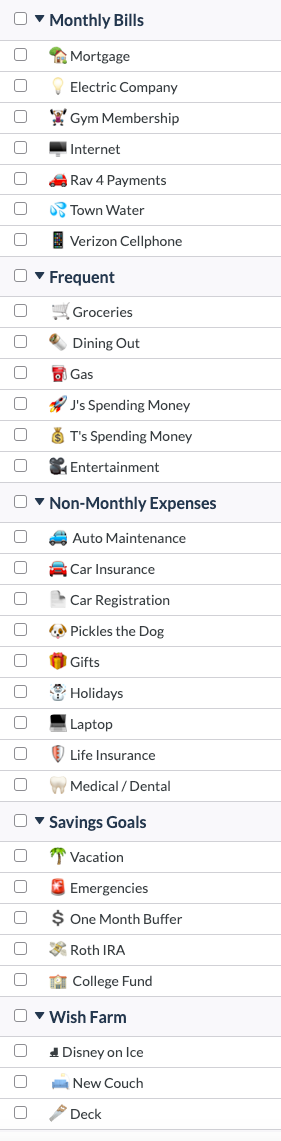

Here’s what that starter budget might’ve looked like:

And while this set of default categories and groups work great for some of us, we want you to know that they’re not your only option. You might have variable income, you might be aggressively breaking the paycheck to paycheck cycle, or maybe you want to save up for a specific fun thing like a vacation or even a blanket ladder.

Changing your categories isn’t wrong. In fact, there’s no wrong way to organize your budget. We can organize our budgets based on the category structure that best fits our lives right now. If we change our minds later, that’s ok and we can restructure again then too.

Here’s an example of categories set up around when you get paid:

And here’s one broken out by theme:

Use any of those as a template to set up your own YNAB categories or customize your own!

Save in Specific Categories,

Spend in General Ones.

Saving money is exciting. There, I said it. As one YNABer, Carsen, put it, “Giving dollars jobs is like getting to spend the money before you spend the money (and who doesn’t enjoy spending money?).”

And the jobs that you give your dollars could be paying for your next new cell phone, a house project, a new refrigerator or a vacation. Whatever you’re saving for, it’s motivating to know that you’re chipping in for a future purchase that will make your life better—and the specificity is what’s so motivating!

But what happens after we pay for the new fridge or go on that vacation? Do you really need a category called ‘Whirlpool WRB322DMBB’ or ‘Woohoo! Costa Rica, 2017, Baby!’ floating around in your budget? It’s a personal choice, but my guess is “No.”

Even if you hide those old categories when you’re done with them, it’s just extra clutter. So how can you save for specifics (that vacay category name is pretty motivating!), without the category remnant muddling your spending reports? Easy! You need a Wish Farm.

With a Wish Farm, you can plant specific seeds in new categories (Costa Rica, 2017!) but, when you harvest your crop (Costa Rica, 2017!), you record the expense under a more general category (Travel). Then you delete your old Costa Rica category and your reports remain clutter-free. Be sure to read that blog post to become a Grade-A Wish Farmer.

Revisit and Revise.

Last, but not least, remember that your budget is a living, breathing thing. Life changes, and budgets should, too. Don’t feel like you have to get it perfect right now—these aren’t permanent decisions. Play with it!

Try a separate category for your coffee purchases for a while—maybe you need a little more focus there. But, when you’re in control, maybe you wrap that back into your ‘Eating Out’ or ‘Fun Money’ category. Your call.

Maybe you simply outgrow a category. Did you just make your last month worth of car payments? Congrats! Go ahead and hit “delete” on that car payment category and start next month with a clean(er) slate. You’ll be prompted to reassign the past activity to a different category so that your spending reports remain accurate—something more general like “Transportation” covers a lot of possibilities.

The point is, keep it simple (where you can!), and always go back to our original question: “Will adding this category actually change my behavior?” (Looking at you, middle-of-the-night Amazon purchases.)

Feeling inspired about changing up your YNAB categories? Check out these five budget categories that you need right now!

Want to start spending and saving in a way that will change your relationship with money…and your life? Try YNAB for free for 34 days—no commitment or credit card required.

%20(1).png)

.jpg)