Venmo has simplified splitting the restaurant check and added ease to other on-the-go reimbursements—no more of that “I don’t have any cash on me” awkwardness—but has added another layer of complexity to the budgeting process.

Money either came or went, but to or from where? What’s the best way to track those expenses?

It might be tempting to think of that Venmo balance as a sort of mystical currency, that sometimes you have and sometimes you don’t, running under the radar of your regular expense tracking. Who doesn’t love the thought of magical money?

When recording any transaction, ask yourself two questions:

- What account did the money move from?

- What job did the money do?

Although it might seem tricky on the surface to wrangle your Venmo account and your budget, it all comes down to answering these basic questions. If you're ready to establish a smooth system for tracking Venmo in your budget, we have some ideas that could help.

How to Manage Venmo in YNAB

The best way to include Venmo in your budget depends a lot on how you use Venmo. People who occasionally use Venmo during a night out have different needs than those who use it daily or weekly to accept payments for their side hustle.

Let’s take a look at our options:

Option One: Don’t Carry a Balance in Venmo

This option is best for the occasional Venmo-er.

If you don’t keep a balance in your Venmo account, it’s essentially serving as a payment processor. Money simply flows to or from your bank account, with Venmo acting as the metaphorical gate it passes through to get there.

In that case, keep things simple and record Venmo purchases like you would any other checking account transaction.

- Ask yourself what account did the money leave from?

- What job did the money do?

- Update your budget and categories accordingly.

Who is the Payee?

When entering Venmo transactions, you can record the Payee as either Venmo or the name of the person you’re paying. We find it helpful to make a note in the memo section that this was a Venmo transaction and what money was exchanged for.

If you’re a big fan of simplifying the budgeting process, link Venmo to your checking account and transfer any money received in Venmo to your bank as soon as you get it. Easy peasy.

Option Two: Do Carry a Balance in Venmo

Listen up, frequent Venmo-ers.

If you use Venmo more like a bank account by maintaining a balance and using it regularly, setting Venmo up as a checking account in your budget might make the most sense for your situation. Think of your Venmo account as a checking account with super powers—the super powers being that it can easily accept and send money to and from others, which is pretty nifty.

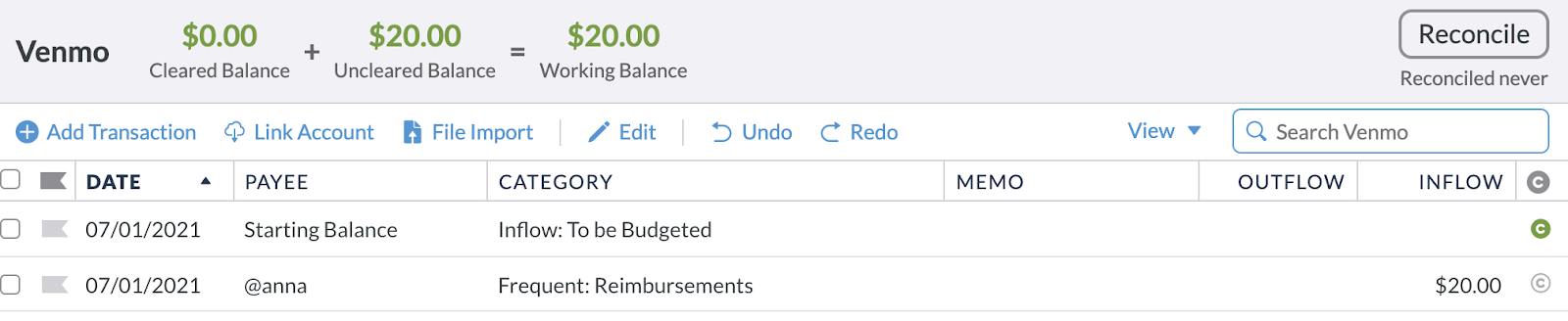

Refer to Venmo’s online statement to keep track of your incoming funds and outgoing expenses so that you can reconcile your accounts, and pay attention to what has and hasn’t cleared yet so that your information is always up to date. You can use one of YNAB’s transaction entry options to add transactions that affect the balance of that account, such as inflows and spending.

Recording Reimbursements

Handling reimbursements within the budget can feel a little bit like that street performer trick where they shuffle the three cups and you try to guess which one is now hiding the ball. If you pay the check with your debit card at dinner, but your friend pays you back through Venmo, how do you record that accurately so that you don’t accidentally rob yourself of that extra money in your Dining Out category?

Which cup is that Dining Out cash ball hiding beneath?

Here’s how it’s done:

Let’s say Eileen and Anna go out for Indian food. Eileen pays the check with her debit card. Which account did it leave? Checking.

In YNAB, she would enter the transaction under her checking account by doing a split transaction between multiple categories. What job did it do? Dining out. Her half would be categorized as Dining Out and Anna’s yet-to-be-paid-back half would be reflected in a category titled Reimbursements.

Now when Anna pays Eileen back (promptly, because she’s awesome like that), Eileen will enter that transaction under her Venmo budget account in YNAB, since that’s the account that was involved.

She will add Anna as the payee and list the amount as an inflow to the Reimbursements category. Since that all happened within the same month, the Reimbursements category levels back out to zero dollars.

Ideally, you’d cover the negative amount in your Reimbursements category from your own money so that you don’t end up with any overfunded categories based on money that’s not actually in your account yet if there’s a delay in repayment. Once you get paid, redistribute the extra money in the Reimbursements category to categories that still need it.

Now what happens if Eileen’s the one who needs to pay Anna back?

Let’s say Anna buys coffee for her and Eileen at their next meet-up. Eileen keeps a balance of $100 in her Venmo account and Venmo will always pull funds from that balance to cover any expenditures. She’d record the transaction as an outflow in her Venmo account from the Dining Out category. She could list either Anna or the coffee shop as the payee, and make a note in the memo section for additional clarity.

However, if Anna and Eileen are roommates and Eileen owes Anna $700 in rent money, that $100 balance isn’t going to cover it so Venmo will ignore the balance completely and pull the money from the linked checking account. In that case, Eileen will add the transaction from within her Venmo account in YNAB, doing an inflow from her checking account. She would then add a second transaction for the Rent category as an outflow.

So, essentially, Eileen handed Venmo $700 (the inflow) and recorded it and then Venmo paid the rent with that money (the outflow) which was also recorded.

If you and your friends pass money back and forth frequently, flags can help you keep track of the status of reimbursements; use one color (like red) when you’re waiting for payment, and another (like green) once you’re paid back. Red flag friendships might warrant split checks in the future in order to avoid the awkwardness of becoming a debt collector.

Learning to manage Venmo transactions in your budget isn’t as complicated as that sneaky part of your brain that enjoys unregulated spending likes to pretend it is. Supervise your money movement, handle reimbursements fairly, and split expenses with ease by incorporating Venmo into your budgeting routine.

.png)