Behind the Scenes: Flattening the YNAB Learning Curve

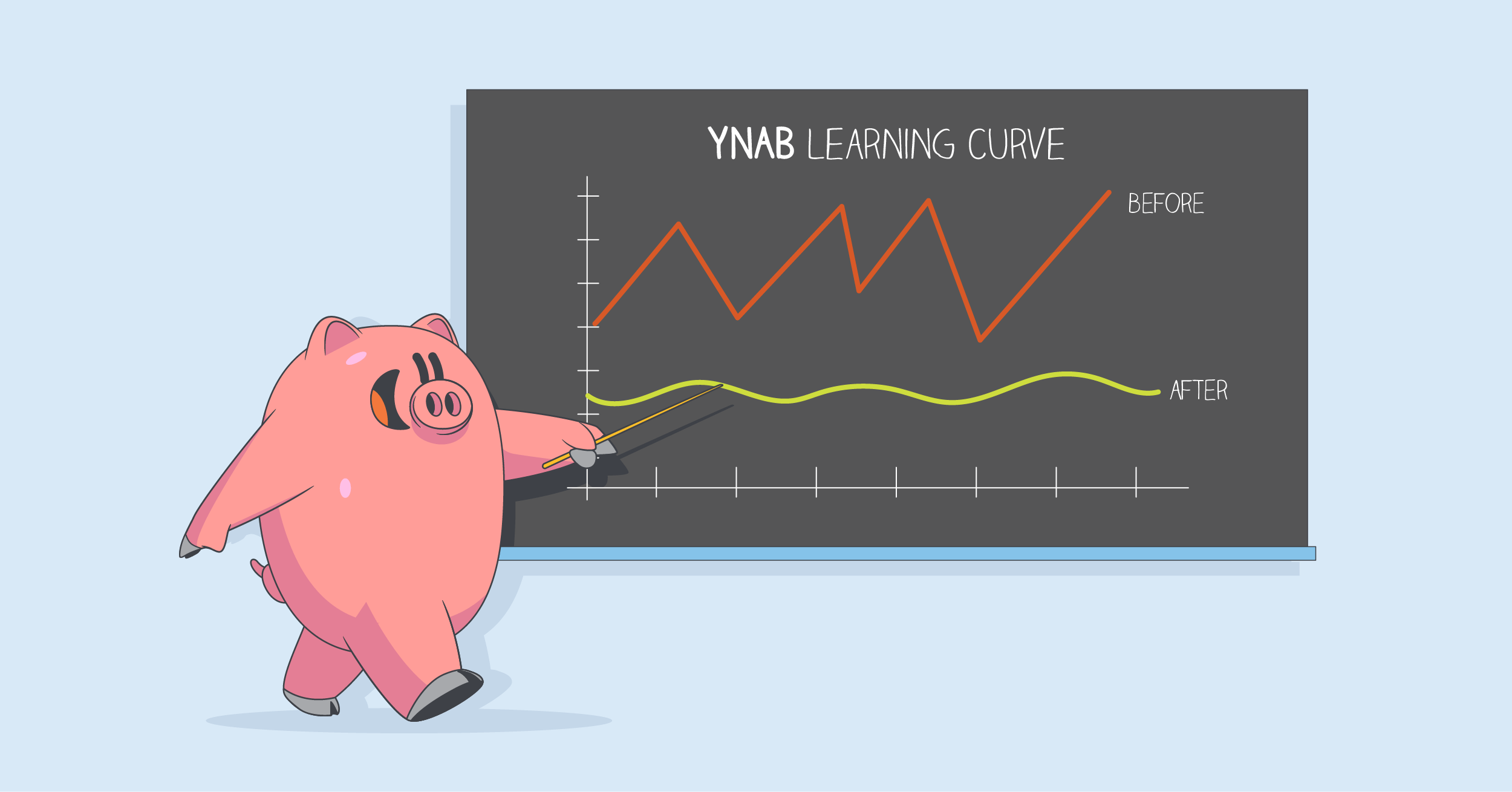

The YNAB method works extremely well—we see the proof of that in the success stories we hear every single day. Unfortunately, we also hear about something else every day: the learning curve. We won’t deny it, getting started with YNAB is more difficult than we would like.

It’s a problem we’ve wrestled with for years. We’ve repeatedly tried to flatten the learning curve within the app—and nothing seemed to work as well as we had hoped. Until now.

We’ve just released some significant improvements to YNAB, many of which are powerful and helpful for everyone. But these changes are particularly fantastic for new YNABers. Here’s why.

Learning How to Budget

Before we look at what’s changed, let’s first consider a brand-new user trying YNAB for the first time. They haven’t read guides, attended a workshop, or even watched a getting started video—they just downloaded the app. Our research suggests that many new budgeters just want to play with the app when they are getting started—there’s hesitancy to watch videos or read instructions and tutorials. Even when they do watch or read our content, there’s so much to take in, it can be overwhelming.

Giving every dollar a job is second nature—but it’s easy to take for granted how much of a mindset shift this actually is.

We get that it’s enticing to dive right in and play with the app—but success with YNAB depends on changing the way you think about budgeting. Until recently, YNAB has been designed to require that change in thinking immediately—but that’s not realistic for most people. Instead, the app needs to meet new budgeters where they are and gradually guide them towards a change in thinking. It needs to meet their expectations—so they can dive right in—while staying aligned with the YNAB method. This is a tough balance to strike.

Finding a Better Balance

Historically, we have designed the YNAB app first, then developed content to teach those designs. This leads to content like popups, explainers, tutorials, videos, etc. This always seemed to make sense—design first, then teach the design.

But this strategy doesn’t work if many new budgeters aren’t using the content we create or never learned how to budget, and we needed an approach that worked for everyone. We found ourselves wondering: what if we reversed this order? What if the teaching model drove the design of the app to begin with? What would that look like?

Enter the Budget Template

While we were exploring these questions and testing early concepts, we noticed the Budget Template taking off in our live workshops. This new concept—which was originally intended to help experienced users set up a month-to-month foundation—was putting new users at ease using Rule One (Give Every Dollar a Job), including when they might not have enough money to budget for an entire month, which was always a really steep version of the learning curve.

As we saw this idea gain traction, the design team thought: “There has to be a way to bring this template idea into the app.” The budget template worked so well in workshops, we were confident we could use it as a teaching model for the app overall.

A Key Change in our Learning-Driven Design

After some failed starts, we created a promising prototype. This prototype made a simple but significant change to the flow of using the app for the first time: We would allow and even encourage a new user to estimate their expenses first, by setting targets on their categories.

This is important because most people budgeting for the first time have the instinct to simply list all their expenses. It’s a natural reflex.

“Here’s how much my rent costs, here’s how much my internet bill is each month…”

Because of this instinct and the way YNAB has been designed, though, most new budgeters actually begin by assigning money, and often assigning more money than they actually have. They don’t yet understand Rule One: Give Every Dollar a Job, and don’t even know that they are actually assigning their money. For long-term YNAB users, giving every dollar a job is second nature—but it’s easy to take for granted how much of a mindset shift this actually is.

Success with YNAB depends on changing the way you think about budgeting.

By allowing new budgeters to estimate expenses first—through making the existing Goals feature more powerful—we could meet new budgeters where they are and help them transition into the YNAB method. Our mission was to let someone new begin taking total control—without violating Rule One.

As we started testing, we could tell this design had promise. Unlike prior designs, every participant was consistently giving all of their dollars a job and not assigning more dollars than they actually had. We were seeing levels of comprehension we had never seen before. Clearly, we were on to something.

Intuitively Giving Every Dollar a Job

In the following months, we continued refining the design and iterating until we completed what shipped today. This latest version contains many details and improvements, both small and large, but the key advancements are:

- Meeting expectations by estimating expenses first.

- Actively demonstrating Rule One.

- Using clear language that assists learning.

Meeting Expectations

We mentioned earlier that we found the first thing people want to do when they sit down to make a budget is to list their expenses. So, instead of adding accounts first (one of the pillars of the prior flow), we now have new budgeters set category targets as a way of listing their expenses—essentially building their budget template.

Actively Demonstrate Rule One

After setting targets to see how much money a new user needs (or how much they think they need, because that perspective changes once actual budgeting begins!), new budgeters add their bank accounts to see how much money they currently have. Once those accounts are added, it’s time to actually assign money to categories—but we needed a way to demonstrate what assigning your money means. Enter Progress Bars and Auto-Assign.

We added Progress Bars to the web app a while ago in preparation for this update, because they play a vital role in the experience. With Progress Bars, you can visually see your funding status at a glance. This makes the process of Rule One much easier to grasp right away.

It was the introduction of Auto-Assign, combined with the visuals of Progress Bars, that really pulled all the pieces together to make Rule One more intuitive. When you are able to set targets and see your category progress bars filling up, Auto-Assign can give every dollar a job in a way that feels logical and intuitive, yet begins that critical process of shifting how someone thinks about their money. And while this was powerful and instructive for new budgeters, we also heard from many long-term budgeters who loved this new functionality.

Clearer Language

Lastly, we took a hard look at the terms we use in the app and simply asked: “How would we describe these things to someone we were sitting next to?” It didn’t take long to spot opportunities for increased clarity. Goals became Targets, Budgeted became Assigned. That’s it. Just two small wording changes and new users started understanding concepts rapidly.

Let’s take a closer look at the change from Budgeted to Assigned. For many people starting out, they think “budgeting” means listing out all their monthly expenses—that first instinct we mentioned. However, budgeting in YNAB means something very different, and we weren’t using words that made that difference clear.

To make things muddier, we also have the Budget tab, there are Budgeted amounts, and To be Budgeted is a category of sorts, containing all the money you can budget to your categories. Consider that YNAB itself is your budget, so to speak, and it becomes clear that the word “budget” was playing too many roles at once. Talking about “assigning” money in our user testing increased success dramatically.

How the New Design Performed

Speaking of success…In our (quite extensive) testing, we’ve seen rates of success that were three to four times higher than anything we’ve seen before. Success, meaning comprehension of Rule One within their first session. Success, meaning clarity on how to use their new budget.

We want someone new to budgeting to open YNAB, get started quickly, and feel excited to keep going and confident that they can stick with it. We’re now a lot closer to that goal than we ever have been.

We’ve seen rates of success that were three to four times higher than anything we’ve seen before.

That level of success is a whole lot more people on their way to the life-changing, life-aligning magic of a budget. This means more people will gain total control of their money. More couples will save their relationships. More people will get out of debt and stress less about money. That’s something every YNABer can get excited about.

We’ve tested our new design with hundreds of new budgeters (and thousands of existing budgeters!), and we’re thrilled that it’s finally clicking. We still have more improvements in the works, for new and existing budgeters alike, but we’re very excited to get this first round of improvements into everyone’s hands.

For anyone who has had that friend, that family member, that you know, YOU KNOW, would find so much more peace if they started using YNAB, there has never been a better—easier—time for them to get started.

.png)