“How can I help my kid build credit at 18?” A friend of mine asked.

Actually, that isn’t true. What she really asked was: “Will you ask Jesse what we should do to help Grace build good credit now that she’s 18?”

And I’m not even mad.

Going straight to the expert source (Jesse is YNAB’s founder) is a top tier parenting strategy. But I could have answered too. Probably. Mostly. It would’ve worked out fine, I’m sure. Maybe it would have; the point is that we’ll never know.

But, either way, Heather, this one’s for you.

How to Build Credit at 18 Years Old

Step one is going to absolutely shock you. I mean, who would have imagined that a guy that started a company named You Need a Budget would say that the first step to figuring out how to build credit at 18 is to:

Help Your Kid Start a Budget

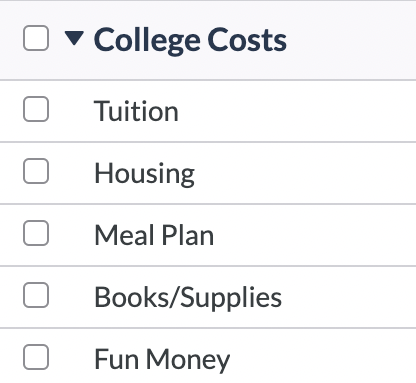

Before your kids are out of the house and well before you attempt to help them establish credit history, do two things: get them a bank account and help them build a budget. Sure, their inflows and outflows are minimal. They may not have a lot of immediate obligations, but the process, the habits, and the principles are what is so valuable. It’s their first baby step into the world of personal finance, and it’s an important one.

You can have multiple budgets under one YNAB subscription, so you can start by helping them create a budget under your YNAB account. Or they can take advantage of the YNAB College Student Program, and get YNAB free for a year.

Teach Them How To Use A Budget

Make it something you do together, not just the one time you set it up, but regularly, maybe every time they get paid or when they get an allowance. If you are comfortable, open up your budget and show them how you prioritize, assign dollars, and account for your true expenses.

Imagine all the stress, anxiety, and debt you could help them avoid if they are fully equipped to live within their means and appreciate the value of delayed gratification before they turn 20.

(Think of all the stress, anxiety, and debt you could have avoided!? Or don’t, because it could get depressing.)

And credit scores aside, if they get in the habit of making on time payments and saving money, they will be way ahead of the game financially.

The Budget Nerds weigh in with a video about how to budget as a college student.

Explain How Credit Cards Work

Before you even think about helping your young adult get access to credit, make sure they really understand interest rates and how compound interest works…for good and for bad. This TikTok video from the Dollar Scholar may help:

Explain that this is how the credit card company makes money. Don’t take anything for granted. Sit down with a calculator and show them how it adds up. If you have credit card debt stories of your own, share them with dramatic flair!

Also, be sure to explain that your credit score is the figure that lenders use to determine the risk of allowing you to borrow money—which can affect everything from car loans to mortgage approvals.

When, and only if, you feel like your child understands how to budget, is motivated to live within their means, is humbled by the thought of compound interest, and understands the long term consequences of a credit score, consider opening a credit card.

Credit cards themselves are not bad; they’re just another financial product. If you treat a credit card like a debit card, only use it for things that you already have the money to pay for, and then pay it off in full every month when the bill arrives, it is a great way to build credit and increase your FICO score.

Be sure your child knows and understands the expectations—and the consequences—before you put any plastic in their hot little hands.

A credit card is not the keys to the kingdom. It isn’t free money. It is simply an alternative payment method, to be used with respect, and perhaps, a little healthy fear.

How to Build Credit at 18

Once you’re confident that your child is ready to establish credit, you have a few options to help them get started:

Add them as an authorized user: If your own credit is in good standing and you keep your balances low, consider adding your child to your credit card account as an authorized user. There is some risk involved with doing this since your accounts are linked; if one or the other of you make a late payment or run up your credit utilization, both of your scores could suffer.

Start with a secured credit card: Secured cards require a security deposit, and that amount becomes the credit limit as well. It requires money upfront, but it’s a great way of helping your child establish payment history to start building credit without as much risk.

Check into a student credit card: If your child is a college student, they may be eligible for a student credit card. These are easier to get without credit history but generally have low credit limits but high-interest rates. This also may not be the “safest” option to start with since there’s not a lot of oversight or the safety net of a security deposit.

Apply for a credit-builder loan: While typically used more often to rebuild poor credit scores, credit-builder loans allow you to borrow a small amount of money, which sits in a bank account that you are usually unable to access until you pay off the full loan amount through regular monthly payments. Although there’s a cost involved, it’s a low risk way to establish credit…as long as you have the income to make the monthly payment on time. These are often offered through smaller institutions like credit unions.

Make Small Purchases and Pay the Balance Off Each Month

Once your child has some fantastic plastic to swipe, now it’s just a game to build credit as fast as possible.

To do this, a proven plan has been to make only small purchases, like just gas, or a cell phone bill, on this card. Set up automatic payment to pay the full balance each and every month.

Not only will this keep credit utilization low, but it gives a credit history of responsible, on-time payments and takes a lot of the guesswork and number crunching out of the equation.

Teach Them to Monitor Their Credit

Managing the responsibility of credit really comes down to mindset. It’s so important to emphasize credit cards as another payment option to use backed by money that you already have—not an advance of money you hope to have some day.

In order to build healthy credit, you don’t need to maintain a credit card balance, you just need to show activity on a statement to prove credit utilization. So, encourage (or enforce, depending on how financially independent your children are) very moderate use of a credit card, with the intention of always paying it off in full every month. Establishing boundaries and maintaining accountability, especially while the account is new, provides the opportunity for teachable moments.

When I was in high school, my dad opened a credit card for me. I was only allowed to use it for gas. In fact, there was one gas station where I was allowed to get gas, no more than twice a month. Needless to say, there were rules.

And every month when he got the bill, he made a whole thing of sitting down together, looking through it and paying it off before the due date. I’m sure there was a lot of eye-rolling on my part at the time, but I never got into any trouble with credit cards. I actually still have that account, all these years later, and for that (and other reasons, of course) I do have excellent credit.

Help your kids become savvy borrowers by providing some oversight and guidance along the way. Also, help establish the habit of regularly monitoring their own credit by requesting a free credit report each year from Annualcreditreport.com so that they can see their credit scores from all three major credit bureaus (Experian, Equifax, and TransUnion).

Lead By Example

The absolute best thing you can do to help your kids build a good credit score is to teach them how to manage their money by example.

How you handle money, how you plan for the future, how you save (or do not save) for big purchases, how you use credit, how you prioritize financial goals—all of it—will inform the way your kids think about money, the choices they make, and ultimately, their credit scores and beyond.

Commit to getting control of your money and budgeting as a lifestyle. If not for you, do it for your kids. You cannot underestimate how much that discipline will benefit them in the long run. And not just because you’ll be able to afford a summer vacation—but because they will learn how to respect the value of a dollar.

Ready to build a budget as a family? Try YNAB for free for 34 days. No credit card required!

.png)

.png)