With the new year, there’s a lot of noise about new beginnings, clean slates, reinvention and do-overs. Or, doing a YNAB fresh start. But, what is a budgeting fresh start, you might ask?

Fresh starts are a useful (and dare I say invigorating?) way for seasoned YNABers to see their money with new eyes. They offer you the opportunity to shed your old budget, like a snake sheds its old skin, to reveal the newest, healthiest version buried beneath.

If you’re newish to budgeting, you might consider a fresh start, too, after you’re in the groove of things—once you’ve established a working knowledge of how you want your categories and accounts organized in YNAB.

So, how does a fresh start work? Let’s take a look.

See how Ernie The Budget Nerd prepares for the new year in YNAB with a fresh start:

What to Expect

Before I tell you how to make a fresh start, you should know that you can change your mind. When you use the fresh start feature, YNAB saves a copy of your old budget that you can go back to. You can play with the new budget to your heart’s content—add, delete or edit your accounts, categories and allocations—and if you don’t like it? Just go back!

Now, I can hear some of you talking at your computer screen. You’re saying, “But, what about my history? What about all that data?”

To you, friend, I say, “Data Schmata. See ya’ lata.”

Just kidding. But, what I would ask you is how that data is helping you? Do you need your paid-off student loan hanging around in your budget? Do you have a glut of hidden categories? Are your spending habits from years past useful—especially if you’ve moved to a new city, joined finances with a partner, or had a child?

Learn more about how to smoothly navigate the highs and lows of budgeting with a partner.

If your life or your priorities have changed, a fresh start is just the thing to bring new relevance (and, therefore, effectiveness) to your budget. Not to mention lightness. Don’t you want to feel light? I thought so.

How to Do It

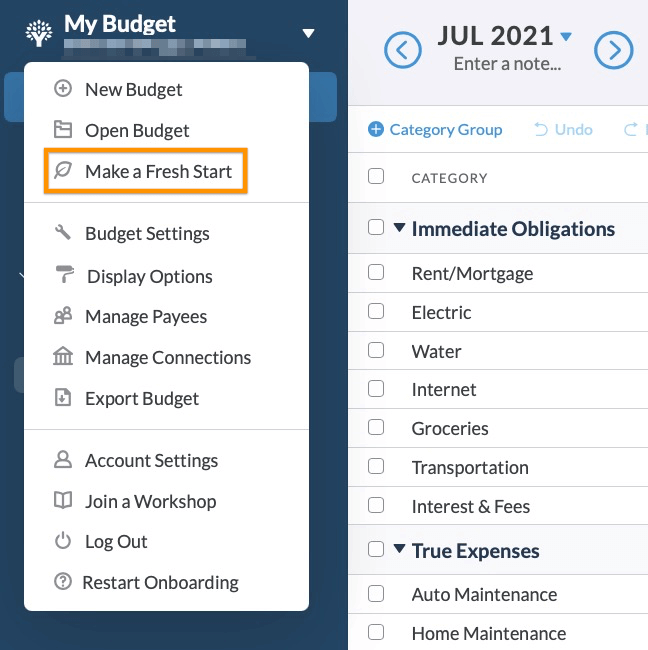

Ready? OK. First, login to YNAB. Then hover over “My Budget” and click “Make a Fresh Start” in the top left-hand corner of the screen.

You’ll see this pop-up with reassuring bolded text (See? I told you that YNAB saves a copy of your old budget!):

Enter a name for your new budget, I’ll use “My Budget2” and click “Continue,” and you’ll be whisked away to your brand-new budget.

At this point, you can go back to your old budget by hovering, once again, over “My Budget” (top left-hand side of the screen), and clicking on “Open Budget”. You’ll see something like this:

See the archived budget? That’s the OB (original budget), and he’s not going anywhere. OK, so, back to the new budget …

Click on “My Budget2” (not the archived OB!), and let’s kick the tires for a bit. You’ll see that, along with a fresh start, you’ve got all of your account names, scheduled transactions, goals, notes, payees and budget categories. Even your Direct Import connections are there.

What you won’t see, however, is all of your old transaction and budget data, ‘cuz it’s time to start fresh. This is where you have some decisions to make:

Simplify Your Accounts

First up, do you really need all of your accounts in YNAB? I decided, for example, to delete my Betterment account when I did a fresh start. I realized that it created extra work in my budget without adding any real value. In other words, seeing those accounts didn’t affect my budgeting decisions.

Now, if you like seeing your net worth, you may decide to maintain your accounts in YNAB. It’s a personal choice, and there’s no right answer.

Streamline Your Categories

Next, take a good, discerning look at your categories. You want your category setup to be simple enough to make budgeting easy, but you want them detailed enough to give you critical insights.

… this delicate balance isn’t as confusing as it sounds—we call it category clarity. As you review your categories, consider the following:

- Will tracking this category affect my spending or saving decisions?

- Would it make sense to lump this category in with another (e.g., Delete the “Coffee” category, and track those purchases under “Eating Out,” instead)?

- Would it make sense to break this category out into smaller pieces (e.g., Replace “Pets” with “Pet food/supplies”, “Pet insurance” and “Pet emergencies”)?

- Have I even used this category, lately?

- Am I missing any categories that would be useful?

Prioritize with Fresh Eyes

Finally, it’s time to give your dollars fresh jobs! This is your chance to take in the big picture and reimagine what your dollars need to do—what are your true priorities, now? What should your money accomplish for you this month and beyond?

Of course, some things won’t change. You’ll likely have the rent or mortgage to pay, and your phone bill isn’t going anywhere. But what about those Savings Targets? Would it feel good to top off your moving fund, so you can finally relocate next year? Or, maybe it’d feel good to fund a bigger emergency fund?

YNAB doesn’t take category amounts from your old budget, so make sure to assign money for both your Credit Card Payment categories and savings categories, if you have them, before assigning the rest of the money in your accounts to other categories. That way you’ll know you’re starting off on the right foot.

Work through each of your categories, challenge your assumptions, budget to zero and have fun!

Just Need a Touch of Freshness?

If that all sounds great, but maybe a tad much, there’s always the mini refresh, available via the Auto-Assign option at the top of the screen. Just open your existing budget, and Auto-Assign gives you a couple of refreshing options:

- Reset Available Amounts: Use this option to move all of your dollars back to “Ready to Assign,” leaving all of your categories with a zero balance. Click it, and you can reprioritize your dollars with fresh eyes.

- Reset Assigned Amounts: As you might expect, this option will change the value in the “Assigned” column to zero. If no categories are selected, it’ll apply to your entire budget—you’ll see a prompt to confirm that decision.

So, without actually doing a fresh start (creating a new budget), you’ll still have a chance to rethink your dollar allocations. Ah, that’s nice, eh?

Want to start spending and saving in a way that will change your relationship with money…and your life? Try YNAB for free for 34 days—no commitment or credit card required.

%20(1).png)