Free Subscription for College Students

Yep, you read that right. Any – wait, every – college or graduate student is entitled to a free subscription of YNAB for one year. Why?

Because I’ve met so many adults, years out of college, who are still being affected by decisions about debt and lifestyle they made when they were barely old enough to vote.

For instance…one time, at a fancy business dinner, I was seated next to a woman in her late twenties who had recently landed a great job. We made small talk – I asked her about her education and what she studied; she found out I worked at a company that offers free budgeting software for college students. She almost started to cry.

Though I had just met her minutes ago, she felt compelled to confess a huge financial “mistake” she had made. (This actually happens a lot to me.)

She had loads and loads of student debt. She was single, making good money, with a manageable cost of living, and yet she was barely getting by because of her student loan payments.

Death By Student Loans

And then she almost broke down. Thankfully the rest of the table was busy in their own conversations. I did my best to console her. I wasn’t quite sure what to say.

Many times, I try to encourage people by saying something like, “As you really become aware of what you spend, your spending will decline.” Or, “Once you start recording your spending on your phone, at the point of purchase, you’ll see your spending align with your priorities, and feel more content – even at your current income.”

But I had to acknowledge that her reality was daunting: a student loan payment larger than rent.

Anyone can use their 20/20 hindsight to point out the mistakes of the past. This young woman was doing that to herself on a daily basis. She really felt she had screwed up. My mind went to all the kids just embarking on their higher education. The way things are going, they’re in for a rude, expensive, soul-sucking awakening.

Tuition costs are higher than ever. They just keep climbing. School loans are easier to obtain than ever before. A bachelor’s degree seems to be the new necessary baseline for a career in just about anything.

For kids today, the expectations seem to be:

- You must obtain at least a bachelor’s degree.

- School tuition is obscenely expensive.

- Debt is your only option.

There’s Another Way

I don’t subscribe to debt being the only option, but I do believe that most kids (and their parents) think it’s their only option. Kids think debt is the only way they can finance their required (and expensive) degree(s).

You can talk about going to a community college for a few years, going to a state school, living at home longer, etc. All of those are options. I like every one of them. Especially the one about my daughters staying at home longer. 🙂

You can talk about not eating out as often, buying a super-cheap beater car, sharing textbooks, working your way through college…

Those are all great options, but I’m talking about more than a personal-finance hack.

Create a Budgeting Mindset

I want these young kids to change the way they think about money. I want them to look at their money (what little they have) and ask themselves, “What should this money do before I’m paid again?”

I want them to deal with scarcity. I want to see their creativity, work ethic, and study habits skyrocket as they solve the issue of their scarcity. They won’t solve it with a mortgage-worth of student loan debt. They’ll solve it with a clear vision of their priorities. They’ll know their priorities because they’ll have worked through Rule One.

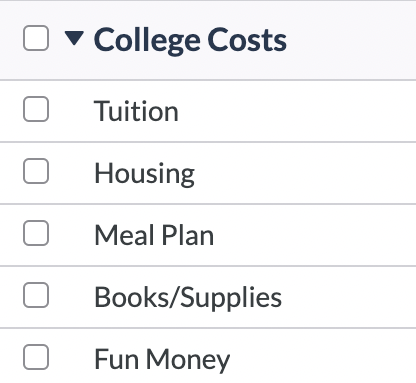

They won’t be surprised by larger expenses (tuition! books!) because they’ll be anticipating those expenses as part of Rule Two. They’ll understand their True Expenses and when they’re prioritizing what little they have, they’ll make sure those True Expenses are accounted for.

They won’t look at their checking account, recently flush from a part-time paycheck (it’s all relative!) and think, Let’s hit the town tonight! No, they’ll look at their “going out” category and realize there are six humble remaining dollars. They’ll opt to split a five-dollar pizza with their buddies.

They’ll be intentional about their money choices, and those intentions will lead them to a place where debt isn’t their only option. For some, debt may support their priorities, but it will be on their terms, with their eyes fully open to the consequences.

College Students Need A Budget

I’m convinced we can have hundreds of thousands of students all using YNAB. I’m convinced that they’ll make it through school in far better financial shape than they (or their parents) would have thought possible. I’m convinced I’ll have far fewer conversations like I did with that sweet, stressed-out young woman. Her reality doesn’t have to be the only option.

That’s why we give college and grad students a free subscription to YNAB for a whole year. Poets, you probably didn’t know it, but now you do!

Sign up here to claim your free subscription for a year and take total control of your money!

Sharing is caring, so spread the word.

.png)

.jpg)