ynab guides

Manage Money as a Couple

When you budget together, you stay together.

Want to learn how budgeting as a couple can help you fight less and align your life goals?

We want to set one thing straight right away: this is not about setting up a life of restriction to reward a saver and punish a spender.

It’s simply about getting on the same page with your money, learning to set goals together, and becoming a team when it comes to your finances.

We’ll even talk about how you can handle money together without losing your autonomy in the process. The secret is employing a humble budget. A budget acts as a third party—you can use it to look at the same figures and speak the same language. It’ll even take the fall when you disagree.

A budget will change everything.

If you’re trying to get on the same page, keep reading!

chapter 1

Why Do We Fight About Money?

Whether you join everything, combine nothing, or meet somewhere in the middle, it gets complicated when multiple people make financial decisions. The fights become tense, and it can feel messy and overwhelming to sort out.

Rest assured—you’re not the only couple to fight about money.

A life together requires compromise and new ways of managing your money. Whether you have realized it yet or not, your priorities have changed. It’s no wonder there’s some friction. Most of our differences come down to two concepts: our money habits and our financial notions.

Different money habits

You and your partner have different habits about making dinner, doing laundry, and how to handle the toothpaste cap. You had to work some of those things out, figure out what was important, and identify places where you could compromise.

Money is no different.

Some habits are related directly to money.

- Do you pay your bills as you receive them or wait until the due date and get them in just in time?

- Do you always save a portion of your paychecks for retirement?

- Do you give a certain percentage of your monthly income away?

Let’s be real—some spending habits are more about how you live your life. Is Friday night always for eating out? Does your significant other wash their car twice a week? Do you have a craft brewing obsession your partner just doesn’t understand?

You’ll want to talk about these things the same way you talked about the laundry and the dishes. Talking will help you identify where you can compromise and how to support each other’s priorities.

Different financial notions

- One of you may consider credit card debt as the ultimate evil, while the other considers debt a useful tool to get what you want quickly.

- One of you might play a game to see how long $5 will last in your pocket, while the other might drop $350 in an online order without batting an eyelash.

- One of you believes a car payment is something you’ll always have, but the other wouldn’t touch a car payment with a 39-and-a-half-foot pole.

Often, your notions about money are shaped by how you grew up. Did your parents or caregivers talk about money with each other? With you? Was money a stressor when you were growing up or a non-issue? These factors can play a role in how you view money and manage your personal finances.

Just like your habits, you may not be able to immediately uncover all of these. Sharing what you know and being open to the rest as it comes will set you up for success.

Some of us are spenders, some of us are savers

People tend to generally fall into one of two groups: spenders and savers. The budget can seem scary to both groups.

The saver says, “We need a budget!”

The spender hears, “You think I’m spending too much money!”

The spender says, “Come on, ease up. Let’s go out for dinner and a movie!”

The saver hears, “I’m not fun enough, and you think fun only happens when you spend money.”

But let’s keep those assumptions in check. Spenders and savers complement each other wonderfully if they work at it a bit.

Spenders

Spenders tend to live more in the moment, happily spending money with little consideration. That’s what money is for, right? If you’re a spender, you may be thinking, “Hey, I work hard for my money and want to be able to buy what I want.”

.svg)

Savers

Savers, on the other hand, have a hard time parting with money. They tend to think more long term. If you’re a saver, you may be thinking, “Hey, I work hard for my money and want to hang on to it.”

There’s no right or wrong here—it’s about balancing priorities. Sometimes, you do really need to save, and other times, you do really need to spend.

Finding common ground

Here’s the secret no one is telling you: the budget helps spenders and savers work together. If you’re the spender and video games are your thing, you can set money aside for that and spend it without guilt. If you’re the saver and you want to create a savings goal for a trip to Europe in three years, the budget can help you focus on that and stay on track.

chapter 2

A Budget Gives You a Common Language

With shared ground and a safe, productive place to talk about what you want your money to do, a budget gives you a place to lay out your priorities and get on the same page. Let’s be honest—we’d all probably like our budget telling us what to do rather than our partner telling us what to do.

Every relationship is different, and it’s important that you give yourselves time to refine exactly how a budget will work for you. Just like your relationship is unique, the way you budget as a couple will be all your own, too. You don’t have to figure this all out from scratch. There are some tested truths that might spare you a few missteps.

You can align on your priorities

A budget critically helps you align your shared priorities. And budgeting is all about priorities.

Budgeting always presents the same question: What does this money need to do for me before more money arrives? To answer that question together, you need to uncover those priorities.

You’ll see what’s possible—and what’s not

With your priorities laid out in front of you in the budget, it will become crystal clear what is possible and what is not. It will give you an honest view of your financial situation. With that information, you’ll be able to make smarter decisions.

So let’s start with the first task: identifying three sets of priorities.

chapter 3

Your Priorities, My Priorities, and Our Priorities

When you’re budgeting by yourself, there’s only one set of priorities. When you’re budgeting as a couple, though, there are three sets of priorities: yours, mine, and ours.

Take the opportunity to budget well and improve your communication. There’s room for mistakes, most of which happen when you make assumptions about your priorities without taking time to fully understand them.

Assuming that my priorities are the same as our priorities can cause problems. So can assuming that my priorities are more important than our priorities. Or that your priorities will take precedence over my priorities. You’re probably a little too familiar with one of these. It can be painful.

The antidote?

Your shared budget and lots of money conversations.

Three sets of priorities, one pool of money

While there may be three different sets of priorities in your relationship, there’s just one pool of money. Deciding where to direct your money becomes very complex when you’re looking at only one part of that pool at a time.

When you see all your money in your shared budget, you’re making decisions together. This leaves much less room for assumptions and second-guessing. You’ll see how my priorities align with our priorities.

Two important moments can make or break a shared budget: honestly laying it all out at the start and regularly touching base on the plan.

chapter 4

How to Start: Lay It All Out

First, you’ve got to share. Surprisingly, this can be kind of scary sometimes—even with the person you’re sharing your life with. These are your dreams, your hopes, your big life plans. You might’ve been keeping these a secret, fearing that speaking them into existence might do some irreversible damage. Take a deep breath. You got this.

When it comes to sharing finances with a partner, you don’t come empty-handed. You bring the money habits and notions about money that we covered earlier, which may be different from your partner’s. You also bring money. Or a lack thereof.

When you begin budgeting as a couple, take the time to sit down and share everything you bring to the table: the good, the bad, the ugly. Yes. Even the embarrassing stuff. This will be some of the most important time you spend together.

You may come to the relationship with good old-fashioned money management issues, like a pile of debt, or even a pile of money (yes, that can be an issue, too). Maybe you’re working a job that doesn’t pay as well as it should, or you’ve got an impending expense like graduate school.

If your particular issue of choice involves debt, you might be tempted to minimize it. That isn’t going to work. It will only make your money issues worse in the long run.

Instead, lay it all out on the table. And keep talking. And budgeting. And budgeting and talking.

Four rules to get you started

Here at YNAB we have Four Rules to help you make progress as you start your budgeting journey:

Rule One: Give Every Dollar a Job

Together, you’ll assign each and every dollar you have to a job in your budget. A job is simply a priority, and Rule One will make sure they’re all taken care of.

Rule Two: Embrace Your True Expenses

Not all expenses are monthly. Some spending can really throw you a curveball, like the holidays, a big vet bill, or an unexpected car repair bill. Collaborate to identify these expenses, and instead of being blindsided, you’ll set money aside for them each month. When those big bills arrive, you’ll both be ready.

Rule Three: Roll With the Punches

For people budgeting together, this rule is a secret weapon. If your priorities change or an unexpected event presents itself, simply change your budget. Did your honey forget to check the dining out category before going to lunch with friends? It happens. No biggie—just move money from gaming to cover it. Remain flexible as you adjust and adapt to everything life throws at you.

Rule Four: Age Your Money

People commonly begin their financial lives living paycheck to paycheck. A dollar arrives today, and it’s right out the door tomorrow. Build some grace into your shared budget and aim to get a month ahead. After you finish budgeting for this month, set money aside for next month.

When you do this, the money you assigned to the next month hangs around for a while before you spend it. Essentially, it gets older as it sits, aging like a fine wine. Old money is better—trust us—and it will get you out of the paycheck-to-paycheck cycle once and for all.

chapter 5

The Power of the Budget Date Night

By this point, you’ve talked about your priorities, my priorities, and our priorities. You’ve shared your habits, your perceptions and expectations about money, and all the financial complications that you bring to the relationship. You’re heading into the Land of Shared Budgeting with great momentum.

How do you keep it up?

Budgeting as a couple means being clear about your priorities. Sometimes, if you’re doing it right, your priorities will change.

You need a budget meeting

At least once a month, you need to clear your schedules and sit down to make sure your money still aligns with your priorities. Successful budget meetings take all shapes and sizes:

- The first Monday of the month, while eating Chinese food

- A written email recap of the budget with outstanding items to review on the first Saturday of the month

- A weekly Saturday session to touch base on upcoming spending and the budget for the week

Question prompts to get you started

A good budget meeting includes some discussion about these and other questions:

- How is your spending trending compared to what you budgeted? Are you getting close to using all the money you gave to a certain job?

- Did you have overspending? Where can you move money from to cover the overspending? Remember Rule Three: Roll With the Punches.

- Have unexpected things come up in your budget? How could you handle them now? Could you change anything about your current budget to prepare for them in the future?

- Could you make any adjustments to next month’s budget with what you know now?

- Are there unusual events happening in the coming month that you could prepare for?

- Are you on track with your long-term goals? If not, do you need to adjust your habits or goals?

- Have any of your priorities changed? Does any part of the budget need to change to reflect that?

Keys to a successful budget date

Your budget meeting doesn’t have to be boring. Make it a date night. Budget some money (of course) for a dinner out or a pizza in, and make that your budget meeting. In the summer, find a coffee shop with WiFi, sit outside and talk about what your financial plan will be for next month. Perhaps reflect on how much you love each other. Whatever works for you two.

Without a meeting, there’s every chance that two-thirds of your priorities (yours, mine, or ours) won’t receive enough attention. It’s not because you or your partner are selfish or manipulative. When one person handles the budgeting, the budget will only reflect their vision. There’s too much room for misunderstanding and for dollars to stray from your priorities.

If you forget to communicate, don’t worry. It’s never too late. When you give every dollar a job, it is not written in stone. If you talk about wanting to make a change, go ahead. Rule Three helps you adapt when you forgot to or didn’t have time to plan together.

And you thought budgeting wasn’t romantic. Just you wait—this might be your favorite time together all month.

chapter 6

How to Budget with a Reluctant Partner

If your partner is skeptical of the whole budgeting thing and doesn’t see the value yet, don’t give up. This is a long game. If you’d told your partner you wanted to spend the rest of your life with them when you first met, you probably would have scared them off. Quickly. Unless your life is a rom-com. In those cases, it always seems to work out.

Approach budgeting as a couple with the same strategic reserve.

Perception is everything

If you come right out with, “We need to start budgeting!” your partner may hear, “Stop spending all our money! We cannot have nice things! We can never dine out again!”

This will, in most cases, lead to some form of hard feelings, resentment, and panic. Defenses will go up. The tension will be thick and hard to navigate, making any chance of healthy communication unlikely.

Delivery is everything—if you lay it on too thick, too strong, or too fast, regardless of what smart or responsible thing you say about budgeting, your partner will hear things like:

- Hey, let’s imprison ourselves financially by doing this budget thing.

- I think you spend too much. I’m going to build this infrastructure and have it in place to check on you at all times and point the finger at you when you do spend money.

- I do this really well, but you handle money really wrong, so I’m going to have us budget to point out all the places where you’re doing it really wrong.

- You know how when we talk about money, we argue all the time? Well, I would like to make it a more formal time where we can make sure to really argue on a regular basis. That’s why I want a budget.

So, stop talking about budgeting. Don’t even use the word.

Focus on the positive

Start with a shared goal—not even a financial goal. Pick a goal, any goal, and don’t even talk about money. You’re just slowly working it in.

If your partner wants to go somewhere on vacation, you just start talking about that vacation—really talking it up. Meanwhile, quietly put away a little bit of money each month for the trip.

At one point, you can say, “Guess what? I’ve been saving money every month for that vacation, and now we can! I’m so excited we can finally just let loose a little, have a lot of fun, and not worry about the money. We’ve got the cash. We won’t have to put a single thing on a card. No guilt. It’s going to be so great!”

Your partner may suddenly be more curious about this whole budgeting thing you’ve been so excited about.

Maybe there is a big bill that surprises both of you or even caused a fight. Start setting aside money for that bill every month, perhaps secretly. You’re not hiding money from your partner, but just go about it quietly. If a similar situation arises, you can now say, “Oh yeah, no worries. I started setting aside $20 each month to make sure we’d be OK next time. We’re all good.”

You just got their attention.

Save for something they want

Instead of nagging your partner about budgeting, show them what budgeting can do, how the little things add up, and how good it feels to spend money on the things that matter most to you. Do they really want a weekend away at the beach? Create a spending category, start saving, and make it happen. Even if that’s not your top priority right now, the cost is small compared to the benefits of getting your partner on board.

Accept that there will be a learning curve for both of you. Be strategic—as you plan, know it’s a long game. Stay focused on celebrating big and small positive outcomes.

Make it easy for them—remove friction

You want to make it as easy as possible for your partner to buy into the budget. That probably means you’re going to do most of the work. Congratulations, household Chief Financial Officer, on your newly elected post. You might love managing the budget, and that’s perfectly fine.

Some partners simply don’t enjoy the daily budgeting process. You don’t have to share the task equally. Focus on communication and keeping each other in the loop.

No one wants to be the budget cop

So, don’t use the B-word if it’s a trigger or a dead end. Instead, work toward creating a safe space to talk about your financial goals and how to get there. Take the time to really talk through your priorities, as individuals and as a couple, and commit to working toward those things.

No one has to be the bad guy, and it doesn’t have to be a whole new fight every time. Deciding what’s most important, committing to those things, and working together to make sure your money is headed in the right direction is key.

Keep talking

As you begin to achieve some little wins, you might find the door creeping open to more communication. Keep talking. Stay focused on the positive outcomes. Keep wrestling with your priorities, and over time, the power of the budget will be undeniable and impossible to resist

When you agree about your priorities and accept that you’re working with a finite amount of money, it makes spending decisions much more straightforward.

chapter 7

The Nuts & Bolts of Your Budget Structure

The YNAB Together feature makes budgeting as a couple a little easier, regardless of how you choose to handle your finances or set up your budget. With YNAB Together, you can share your subscription with a partner (at no additional cost!) so that both of you can update, edit, or reference your household budget, or create additional budgets, from separate log-ins. Whether you share financial accounts with your partner or keep them separate, your YNAB budget can be set up to accommodate different scenarios.

Here are some options to consider as you begin budgeting as a couple:

Scenario One: All accounts are shared accounts.

This option for budgeting together has the fewest moving parts—it’s one single budget shared between partners.

Here’s the setup:

- All your accounts feed into the same budget.

- As paychecks roll in, you work together to give those dollars jobs.

- When you get paid again, rinse and repeat.

We highly recommend each partner having their own “Splurge Money” or “Fun Money” category to keep some level of personal autonomy in a shared budget. We’ve seen these monthly funding amounts range anywhere from $5/month to $500+/month. It’s all up to you.

Scenario Two: All accounts are separate accounts.

In this case, you will each have a separate budget with separate accounts feeding each budget. Often, even with separate accounts, people share expenses. Your budgets should mirror your real-world payments.

Meet Joe and Sue

Let’s walk through an example where both people pay 50% of the $1,200 rent. In this case, Joe gives Sue $600. Sue writes the check and pays their landlord $1,200.

1. Sue budgets for rent.

Sue should create a rent category in her budget and budget her portion of the rent.

2. Joe budgets for rent.

Joe should budget $600 to the rent category in his budget.

3. Joe pays Sue.

Joe will pay Sue $600. He will record this as a $600 outflow in his budget, paid to Sue for rent.

4. Sue records Joe’s payment.

Sue will add a $600 inflow to her budget, paid from Joe. She will assign this money to the rent category, bringing the total amount budgeted to $1,200.

5. Sue pays rent.

Finally, Sue will write the check to the landlord for $1,200, categorized to rent.

That’s what happened in the real world, so that’s what needs to be recorded in your budget.

Scenario Three: Some of your accounts are shared and some are separate.

There are two ways to handle this, with pros and cons to each approach. Choose the one that will work best for you.

Option A: Individual accounts feed individual budgets, with shared accounts feeding into a shared budget.

This method requires you to have three separate budgets in YNAB: the shared budget and two separate budgets.

The shared budget should only include shared categories (groceries, utilities, rent, etc.) and shared accounts.

Each of your personal budgets should only include categories and accounts specific to you as an individual.

Meet Alex and Jordan

We’ll take a look at how Alex and Jordan would structure their YNAB budgets with this option. Let’s say they share the following expenses and have one shared bank account in the shared budget:

Alex pays for the following expenses, which Alex tracks in their budget:

Jordan pays for different expenses, which appear in her budget like this:

Pros

- This is the cleanest approach.

- By keeping separate budgets, there’s a clear definition of what is shared and what is not.

Cons

- It can be a little more work to move money between budgets.

Here’s an example to see this setup in action: Alex bought dinner, and Jordan wants to pay them back $25.

1. Jordan budgets for eating out.

Jordan needs to budget the $25 for eating out in her individual budget.

2. Jordan pays Alex.

Jordan then pays Alex and records this as an outflow from her eating out category.

3. Alex records the payment.

Alex records the inflow, then assigns those dollars wherever they want. They could budget it to dining out, but if the dinner was already covered, they could use the money elsewhere in the budget.

Remember: YNAB is record-keeping software. You still need to write the actual check or Venmo the money if that’s how you handle these scenarios.

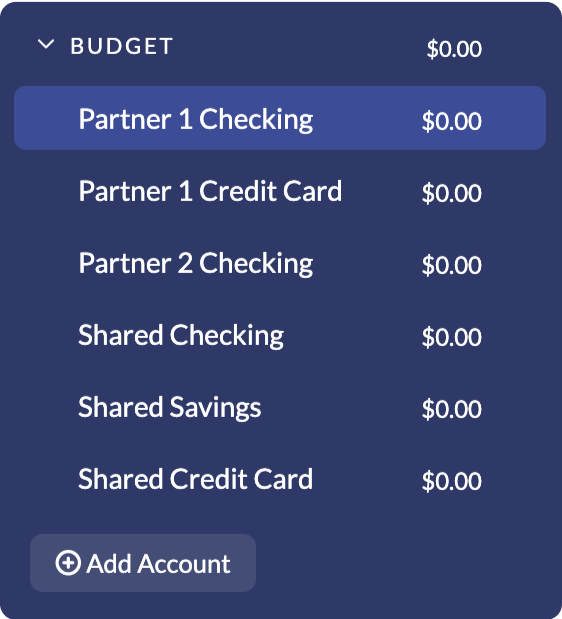

Option B: All accounts, both joint and individual, feed one single budget.

In this situation, individual account money separates into different category groups. Both partners add their accounts to the same budget. This is how Alex and Jordan’s YNAB budget would be structured with this option:

- Alex’s Checking Account

- Alex’s Credit Card

- Jordan’s Checking Account

- Shared Checking Account

- Shared Savings Account

- Shared Credit Card

With all accounts in the same budget, categories and category groups help to split their income up.

Shared Expenses

Categories that Alex and Jordan split like rent, utilities, food, gas, and vacation are grouped in a Shared Expenses category group.

Alex’s Expenses

Alex assigns money from their account to their category group. Alex tracks expenses like auto maintenance for their Camry, student loan payments, clothing, and fun money.

Jordan’s Expenses

Jordan assigns money from her accounts to her categories like fitness, medical expenses, and her own fun money.

Transfers

If either Alex or Jordan put money in the joint accounts, that’s a transfer on the account side. For example, Alex transfers $1000 to the shared checking account every month to cover the shared expenses.

In YNAB, they would record a transfer from the individual checking (Partner 1 Checking) to the shared account (Shared Checking). You don’t need a category since all of the accounts have already been added to the budget.

Pros

- Everything can be viewed from one budget.

- It’s easier to move money around.

Cons

- It’s easier to accidentally move money to the wrong place or without the other person knowing.

Regardless of your specific setup, the important thing is to find a structure that works for you in which you both feel heard, respected, and able to reach your goals.

chapter 8

You Have a Budget, Now What?

You’re in this together. You’ve joined your budget and your accounts.

That doesn’t mean you can’t be efficient. Sharing your priorities and budgeting with a partner means doubling your budgeting joy, rather than doubling the time and effort you spend managing it.

As a part of your budgeting meeting, make some conscious decisions about your budgeting responsibilities:

- When you receive new income, will one partner be responsible for initially budgeting that money, or will you sit down to do it together?

- If you overspend and need to re-prioritize with Rule Three, will one of you make those decisions? Do you have a shared idea about which of your priorities might have to take a back seat when overspending happens?

- Who’s going to take care of the nuts and bolts—things like coordinating your bill payment through your bank and reconciling your accounts to make sure that your data is always accurate?

Clarity about these questions keeps your budgeting simple, which is incredibly important. Keeping it simple allows you to remain focused on what’s important, like clarifying your priorities and reaching your goals.

You’ll also be a happier, better couple. Every time you communicate about your finances and budget, you remove an obstacle in your relationship. It’s not uncommon to have misunderstandings about money, but with a shared budget, clarity on priorities and responsibilities makes them much less likely to happen.

Budgeting bliss, together. It’s closer than you think.

chapter 9

Five Tips for Success

We know budgeting as a couple can be a journey, so here are some tips as you get started on yours.

Take the Lead

If they’re reluctant, don’t complain—step up. You could use it without them for a while, if necessary. While you may not make as much progress, you’ll likely make some, gaining valuable insight into your spending habits. That will be helpful during your monthly budget meeting.

Show (Don’t Tell) The Power of Budgeting

We talked about this earlier, but it’s worth a second nod. Show them how the budget can get them what they want. Demonstrate how it’s not about restriction, but freedom.

Make Sure You Both Have Your Own Money

Make sure you each have money to spend on whatever you want without having to check with the other person. Talk to determine the right amount, and once you’ve done that, let it go. If they want to spend it on things you find frivolous, it doesn’t matter. It’s just another opportunity to indicate that the budget is not about restriction.

Make the Budget Easy to Access

If your partner is a mobile phone user, we have free apps for Android and iPhone, along with Widgets, as well. Widgets are perfect if you just want someone to keep an eye on a few areas of the budget.

Celebrate Success

Make time to celebrate the big and small wins. Even something as small as paying all the bills on time is huge. Did you come in under your budget on groceries? Huzzah! Save for that weekend at the beach. Enjoy!

chapter 10

Next Steps

Now you’re budgeting together. It’s a big deal! Congrats on your life together. You’ve come this far, so let’s recap what we’ve learned.

- A budget simply gives you a shared look at your priorities and what you want your money to do.

- Lay out all your habits and notions around money on the table. Be honest with each other.

- You will have three sets of priorities: your priorities, their priorities, and your priorities together. Make sure all three are captured within your budget.

- Encourage a reluctant partner by getting something they value with the help of a budget.

- Structure your accounts and budget in a way that works for you. It can be shared accounts, separate accounts, or a hybrid of the two.

- You do not need to shoulder the budgeting responsibilities equally. It’s common for one partner to do the day-to-day budget and the other to take a more hands-off role.

- Have a standing budget date.

Find your rhythm and experience the bliss of being on the same page with your partner when it comes to money. Goodbye, money fights!

chapter 11

Additional Resources

Ready to learn more about budgeting as a couple? We’ve got everything you need to know about managing money with your honey:

- Budgeting for Couples When You Don’t Share Accounts

- Make Room For Yourself While Managing Money Together

- We Couldn’t Agree on How to Handle Money

- A Date Night That Pays Off Debt

- 84 Financial Questions to Ask Your Partner

- 5 Tips for Financial Bliss

- Can a Spender and a Saver Live in Financial Harmony?

- How We Manage Money as a Couple

- 4 Ways to Get Your Partner on Board

- Best Personal Finance Apps for Couples

- Fund Your Future Together

- Budgeting with a Partner: An Overview

Get the Money Night, Done Right worksheet

Ready for money night, done right? YNAB’s free worksheet uses a simple structure to make conversations about finances more productive and inspiring.

.png)

.svg)