How to Make a Budget for Separation

Need to figure out how to make a budget for separation? You might be dreading this moment, or it just seems so darn complex that you’ve put it off as long as possible. If you and a partner are separating, it’s no secret that money can be a thorny and painful issue.

This post will guide you some basics on how to budget for separation including:

- Initial steps to get organized

- Making a plan for upcoming bills

- A budget template for starting your financial life over as an independent person

But first, one long, deep breath.

Got it? Holding it there?

And exhale.

Right, we know this topic can feel super heavy or overwhelming, and just one nice deep breath gives us a little push forward.

Ok, let’s dive in.

Step One: Get Organized

Earmark a couple hours on the next rainy day to get everything consolidated. It might require some password summoning and a few frustrated treasure hunts to find account statements, but hang in there, keep the fidget spinner nearby, and the good news is that this is usually a one-and-done activity.

1. Make a List of Your Finances All in One Place

You’re gearing up to separate your finances, and a good place to start is knowing what’s in the pile in the first place. This list should include:

- Checking and savings account balances

- Cash on hand

- Credit card balance(s)

- Outstanding loans/mortgage

- Retirement accounts

- Brokerage accounts, HSAs, stock options, business

Whether you do this step with your partner or on your own is up to you and your situation. Depending where you are in the separation process, these financial accounts might be closed or about to be closed (and it’s a good idea to download statements and open your own bank accounts, and definitely talk to a lawyer earlier rather than later).

Splitting up assets is for the court to decide, but for now, you want your records neat and tidy.

To illustrate how this all works, we’re going to take a look at a hypothetical couple—Tanya and Mark Scissors—as they prepare for financial separation. Tanya and Mark have one elementary-school child, own a house, and they both work and make similar salaries. (Go Tanya! Slay that wage gap!).

First things first, all their accounts and loans are listed out in one place, shown here in their YNAB budget.

Like many folks, the Scissors have a little bit of credit card debt, a handful of car loans and student loans, some retirement savings, and some liquidity in their home. If you’ve never seen your finances in one spot, this is a strangely comforting activity to see it all in one place. Who knew.

2. Get Granular With Your Expenses

After creating this big-picture financial view, it’s time to drill down into your current bills and expenses. This granular list will give you a clear and tangible picture of how much your current life costs each month and help you plan out the next few months’ of cash flow. Create a guesstimate of your current expenses, including things like your rent or mortgage, loan payments, bills, and both your monthly and non-monthly expenses.

For Mark and Tanya, their list of expenses totalled about $5,500/month. That includes the money needed to pay their bills on time, cover the payments on their loans, buy food and gas, any childcare expenses, and it includes non-monthly expenses too like car insurance and software subscriptions. It’s easy to forget those last few, but this is key to getting the true cost of expenses for a month.

3. Determine Each Person’s Split of Current Bills

For expenses they shared, like the mortgage payment and the monthly bills, the total of shared bills was $2,500. This is an important number—this means if they split current bills evenly, each person is responsible for $1,250. We’ll come back to this number.

Step Two: Split Your Immediate Financial Responsibilities

This is the hairy part that can sometimes become a monster with teeth. We’re not lawyers, nor are we financial planners, so those details of “who gets what” will be hashed out by those professionals.

However, between now and then there are some financial questions leading up to the official divorce you need to figure out. Although nothing decided becomes official until a judge makes it so, the bills don’t get put on hold just because of divorce proceedings.

Questions to consider: from now until the divorce is finalized,

- Who is responsible for car payments (if applicable)?

- Who is responsible for debt payments?

- How will you divide shared expenses?

- Who is paying the mortgage?

- Who will be responsible for the house bills?

- What other bills need to be paid for the next six months?

- Will one person transfer money to the other for expenses? If so, how much?

- Who is responsible for childcare expenses?

- What is your current financial situation? Do you feel secure?

- How much cash do you need to make it through the next six months? (We’ll drill down into this one in the next step.)

- Are there any accounts that need to be changed or statements that need to be downloaded?

Between now and the finalized divorce, the Scissors divided bills and expenses like this:

Tanya:

- Staying in the house (with their child), mortgage payment split evenly

- Drive the Jeep, responsible for Jeep loan payment

- Responsible for her student loan payments

- Responsible for half of shared expenses (totaling $1250/month)

Mark:

- Moving out, getting his own place

- Drive the Prius, responsible for Prius payment

- Responsible for his student loan payments

- Responsible for half of shared expenses (totaling $1250/month)

Step Three: Make Your Budget for Separation

Financial health is yours for the taking. Even when it feels like everything else is out of control, your current money management is within your control. First up: add your expenses operating independently from your partner and on your single income. Whether you’re anticipating child support or alimony, the best step is to operate only under your current reality. That means if you’re not getting those payments now, don’t make your budget including those payments until they start hitting your account (which could take many months).

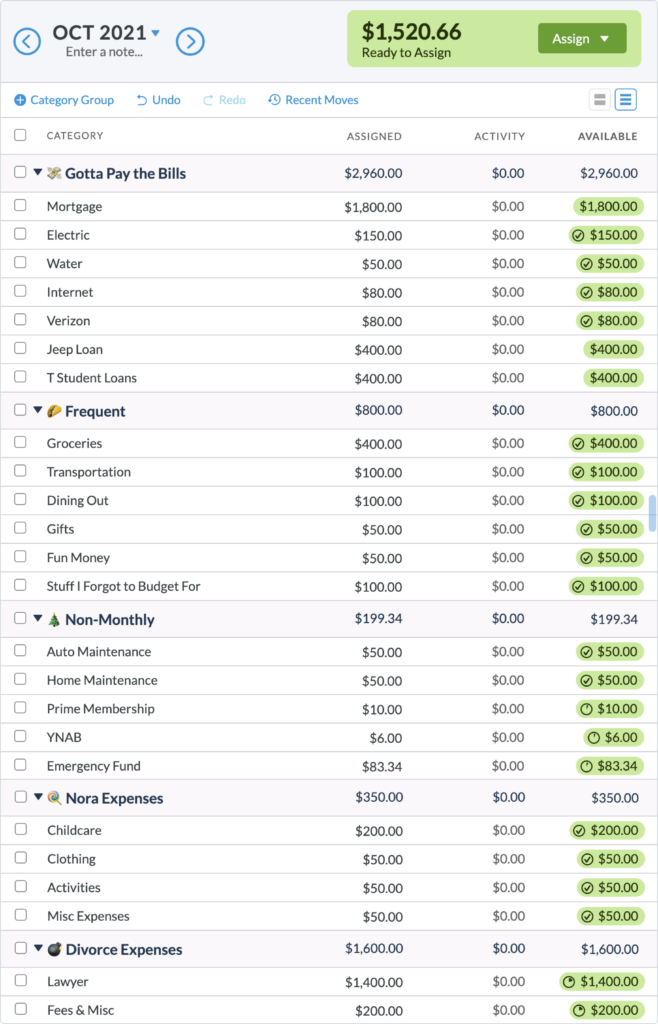

For the Scissors, Tanya set out creating a budget (who knows what Mark is doing), and she made a list of her expenses for the next few months that looked like this:

She added the bills she’s responsible for paying for (the full amount), added in costs she knows are coming for the divorce and lawyer, and even included some fun money for some guilt-free and much-needed treats. Thanks to her list of expenses together, she has an idea of the cost of her current standard of living and can make any adjustments needed.

Add Your Accounts

Next, tally up the money that is currently in your possession (in which you’re the sole owner) by adding current account balances.

For Tanya, it looks like this:

Since the credit card is in Mark’s name, she’s taken out a new credit card and has no balance currently (the credit card debt will be sorted out in the divorce proceedings. For now, Mark is just paying the minimums).

Add Any New Inflows

Tanya’s paycheck from work clears the bank, and Mark has (thankfully) just Venmo’d her for his half ($1,250) of the bills.

Give Every Dollar a Job

Now we’re about to start really budgeting, and it’s about to get kinda fun. YNAB’s first rule of budgeting is to Give Every Dollar a Job. What does that mean? Picture this: you have a pile of cash and a bunch of little paper envelopes with category names written on them. You’re going to divvy up the money you have into these envelopes.

In YNAB, we do that all digitally. Let’s take a look at Tanya’s budget. With all her cash combined, she’s got $7,430 to start with.

One big important note: Tanya isn’t budgeting any money she doesn’t have: that means no upcoming paychecks, no anticipated alimony or divorce payout. Just the dollars she currently has, and that’s what gives her the clarity she wants to make decisions.

Here’s a look at Tanya’s budget before she assigns money to categories. Next, see how she allocates the dollars she has and see what her budget looks like next:

Now Tanya’s budget is filled with happy green bubbles which means each category is fully funded for the month. This even includes earmarking $1,600 for divorce expenses and already saving $80 toward an emergency fund.

Budget to Zero

Now, to fill up all her expenses for the month, she didn’t need to allocate the full $7,430—her monthly expenses cost less than that. That means she’s got $1,520.66 to go. Give Every Dollar a Job is YNAB’s Rule Number One of budgeting, and that means we’re not done yet! From here, Tanya can either:

- Beef up a category like lawyer expenses or emergency fund

- Start budgeting into next month

She opts to get a head start on bills and puts the money towards next month’s bills. With the money she has right now, she’s able to fund almost half the mortgage and almost all her bills for next month. She’s budgeted to zero and now has a plan for her money!

If you can’t fund your full month yet, absolutely no worries—most people can’t when they start. Just ask yourself: “What does this money need to do before I get paid again?” and fill up your categories according to that mantra. When your next inflow arrives, budget it by asking the same question.

Step Four: The Next Few Months of Your Budget for Separation (What to Expect)

Financial and marriage separation is a tangled process, and this budget will give you a plan all the way to the divorce, and it’ll adjust and grow as you do too.

When Tanya gets paid again, or gets another inflow from Mark, she’ll repeat the same exercise and just keep budgeting down her categories until she gets to zero.

If you go through divorce proceedings, there will be divorce-related expenses like retainers and court fees. If you need to shuffle money around, then you’re doing it right. When overspending occurs on a category, or an unexpected expense comes up, just move money from one category to another to cover it. This is another one of YNAB’s core rules: Roll with the Punches. No need for a broken budget, just dip, dive, dodge, and duck and keep going!

It also might feel like your life is in a holding pattern, but there’s no reason you can’t start building a strong financial foundation right now. Ask yourself, what can you do so your finances are better a year from now, five years from now?

Better yet, be inspired by one woman who called it quits on her marriage, then traveled to 26 National Parks (some multiple times), lost 60 pounds, and got herself the best financial shape she’d been in for years, all the while waiting for her half of the house payment to come through. Read it now.

Step Five: Survive and Thrive

You’re taking it one day at a time, and before you know it (ok, maybe you’re aware of every step of the way), it will be behind you. When things feel confusing financially, just keep following the YNAB Method and it’ll serve as your helpful compass through bogs and fogs and financial swamps. You’ll start seeing your progress compound, and you’ll have your independence, your freedom, and the chance to thrive financially, better than you ever have before.

Want to take a trip to Fiji? Put it in the budget. Make it happen, pay for it in cash. Send your kids to private school? Buy a cottage in the country? Maybe you just want to make it through today, feeling just a little more in control of your money. And that is a worthy enough goal in and of itself.

Find clarity in financial chaos: organize your money in a YNAB budget—try it free, no credit card required.

This post is not meant as legal advice and is to be used for educational purposes. We recommend you talk to your lawyer or financial advisor about the details of your financial separation during divorce.

.png)

%20(1).png)

.png)