At the end of the year, some people look back at photos, their calendar, or their Spotify wrapped. If you’ve got an appetite for reflection and nostalgia, well—what about looking at your budget? Nothing could be a truer history of what you did last year.

Let’s take stock by using the visit of three ghosts (er…reports) of your budget: past, present, and future.

The Ghost of Budget Past: Income v Expense Report

This friendly little ghostie can be summoned up with a few swift clicks in the YNAB desktop app. There’s a treasure trove of data just waiting for you in the Income v Expense section of Reports.

In the drop down options at the top, choose the categories or accounts you’d like to see. For a look back at the last 12 months, use This Year for the timeframe.

Shazam! There’s your year! At the bottom, you’ll see green numbers (which means you’re spending less than you earned—way to go!) or red numbers (you saved up and purchased a big item or more money left the budget than was brought in—whoopsie doopsie).

Some months might be green, and some might be red, and your whole year might look a little bit like an alternating string of Christmas lights. Pay careful attention to that Total on the far right for the truest glimpse at your big-picture progress this year.

While you’re visiting the ghost of budget past, take a scroll through the Average column next to the Total. Finally, you see the real story of your monthly inflow, your grocery spending, and your vacation costs, all averaged over a year into an accurate monthly cost. These are great numbers to chew slowly, digest, and think about.

When I looked at my report, I learned my husband and I actually spend a very equal amount of fun money (within $3 of each other) when it’s averaged out over a year. He saves up to buy big things (like mountain bikes) every once and awhile, while I do a concert here and a coffee there. And here I thought I was the saver and he was the spender. Well, if he’s reading this, it’s official: I eat my words, thanks to the Ghost of the Budget Past.

Ghost of Budget Present: Net Worth Report

The Ghost of Budget Past leaves us, and in whooshes the Ghost of Budget Present. What does this ghost have to show you? Let’s dive into the next report: Net Worth.

One quick aside: this ghost definitely isn’t putting your worth as a person against this report. No, no, no. This isn’t like every sport out there (aside from golf and cross-country): higher numbers don’t mean you win, and lower numbers don’t mean you lose. It’s what you do with your money within those numbers that actually matters. I digress. Ghost of Budget Present, take it away!

In the web app, you’ll find your Net Worth in the Reports tab. Use the timeline at the top to select This Year and you’ll see the total of what you have in your accounts, and how it has changed over time. It’s what you own, less what you owe.

As you spend less than you earn, and pay down debt, your net worth will increase. This chart also might show you that this was the year you finally became debt-free as your blue bars surpassed the orange ones (which felt like a thousand dazzling butterflies took off at once. Oooh! Ahhh!).

Ghost of Budget Future: Spending Totals and The Wish Farm

G’bye Ghost of Budget Present. Hello Ghost of Budget Future! How you doin’?

This Ghost takes you through our last report: Spending.

But wait! Spending seems like a Ghost of Budget Past thing.

Well, this one is a team effort…because your spending will inform your future.

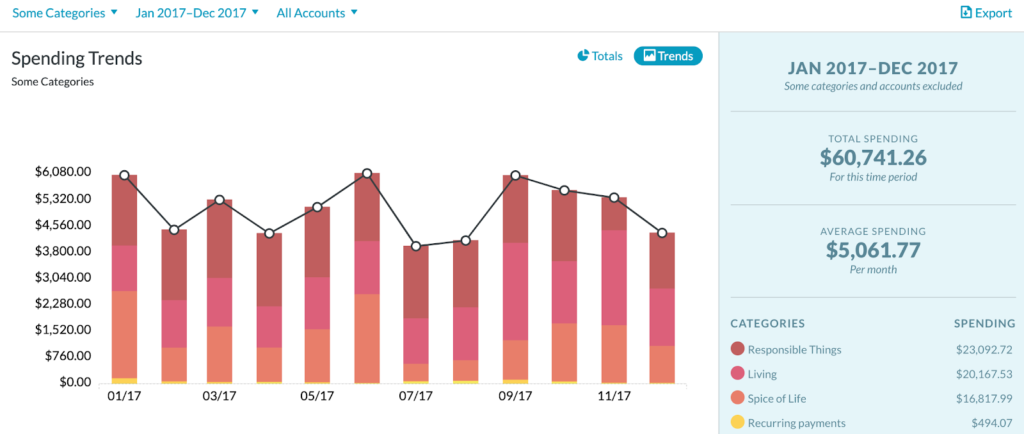

In the web app, choose Spending from the Reports section and select This Year as the timeframe. It may default to Totals, but we want to see the Trends.

On the right-hand side, you’ll see an “Average Spending” per month number: this tells you a very accurate picture of how much money you spend on a monthly basis. You now know what numbers to use for goals in each of your categories next year. Are you spending $388.97 a month on groceries? Create a goal for $400 and you’ll be in great shape.

In more sparkling Ghost of Budget Future lessons, you see what will be purchased in the future with Wish List and Wish Farm categories. These are things you want to buy or need to purchase, but you haven’t done so yet.

In the Wish List below, you see a list split out by small (S), medium (M), and large (L) wishes.

You’ll eventually fund these wishes and move them to your Wish Farm to grow and eventually buy. Listing them out lets you be super intentional with your money and your wants. Can’t wait for that new dutch oven like Erin’s!

And with that, the Ghosts of Your Budget Past, Present, and Future leave you. But, if you want to keep them around it is possible to export your YNAB data and reports. Just set the report to look exactly how you want it exported (categories, dates and accounts) and then click export in the upper right corner. This is a handy tip for sending to your accountant, using for tax prep, or going five levels deeper into financial management, as I’ve laid out next!

Get Your Financial Big Picture

I like to take my reports one (or five) steps further to inform the full picture of our financial year in review and to prep for the year ahead. It’s one day a year and I go all in on financial management. If you’re jivin’ with that level of granularity, let’s take a deeper dive and set up your full financial year in review with a multi-tabbed spreadsheet (budget nerds, raise your hands with me).

I should also say: my husband doesn’t use the budget much but this is a great way to get on the same page on all things financial in one streamlined conversation. You prep the doc, then take an hour to go through it all.

- Get a clean view of your averages and total spent for the year. To do this, Export your Income v Expense report and open it in Sheets or Excel. Set up three columns: the category, average, and total and clean up the data. This helps me set up next year’s budget with the amount we actually spend rather than just my guesses or hopes.

- Compare the numbers to last year’s trends (if you have them). This is the best look at evaluating any lifestyle creep or financial wins. I take the cleaned up data from part 1 and put it side by side to the cleaned up data from the prior year. This is where I saw we spent $200 less every month on groceries than we did the year prior! This was the year I started checking the budget before I spent instead of just using it as a tracking tool! 😊

- Create a bigger picture of your net worth. The net worth report in YNAB is lovely, but if you don’t track your retirement accounts or other investment accounts, you don’t get the full picture. I add a new tab to my spreadsheet and set up a little list of our investment account amounts, HSAs, retirement amounts, and liquid cash amounts. Then I created a list of assets for big things like cars and our house, what they’re worth, and if we owe anything on them. At the end of this exercise, I have our total physical assets, total debt, retirement account totals, investment account totals, and liquid money totals to get that laser-point singular net worth number.

- Scratchpad: know your monthly expenses and monthly inflow. There’s no simpler time to see your real numbers here: I pull our monthly expenses average from the budget, along with the monthly inflow (just paycheck amounts: no bonuses, tax returns, or other random inflows). Look at the two numbers together. Make your budget work within that inflow amount: and give yourself breathing room wherever you can.

- A tab for your big dream. When we did this exercise last year, our goal was mapping out the plan for getting into our dream house. We ran the math: the estimated cost, our desired mortgage amount, the required downpayment to get there. How much we needed to stash away each month if we were going to buy in 3 years…4 years…5 years. We settled in on a rough plan that was reasonable and felt like the right pace. Thanks to this exercise, we were able to set a savings goal to the year.

- Take action on your plan. Within days of completing this exercise, I set up automatic savings on the first of every month to hit this goal (without needing to rely on my memory or self control), printed out a progress tracker and hung it in our closet, and we made all the other annoying financial tweaks you put off every other day of the year (rolled over an old retirement account into one consolidated place, changed levels on 401K contributions, made sure we were at the right tax withholding amounts. Barf. I know.). But then it was done. And I was ready for the year ahead!

And wow, wouldn’t you know: we more than surpassed our goal target (by almost double!). It’s amazing what a little focused effort can produce.

This year when we review, we might see that dream house might come a little sooner, or maybe our priorities have changed and this cute little house will do just fine. Either way, we’re paving the way for those big dreams to happen in whatever form they take.

After you’ve taken stock of your year, your current state, and your future, take some steps to make those big dreams happen.

.png)